Growing Regulatory Pressures

The data discovery market in South America faces increasing regulatory pressures as governments implement stricter data protection laws. Compliance with regulations such as the General Data Protection Regulation (GDPR) and local data privacy laws necessitates robust data management practices. Organizations are compelled to adopt data discovery solutions that not only facilitate compliance but also enhance data governance. This trend is likely to drive growth in the data discovery market, as companies seek tools that provide transparency and accountability in data handling. The financial implications of non-compliance can be severe, with potential fines reaching up to €20 million or 4% of annual global turnover, making investment in data discovery solutions a strategic priority.

Expansion of Data-Driven Cultures

In South America, there is a marked shift towards fostering data-driven cultures within organizations. Companies are increasingly investing in training and resources to empower employees to leverage data effectively. This cultural transformation is essential for maximizing the potential of data discovery tools. As organizations prioritize data literacy, the data discovery market is expected to benefit from heightened demand for user-friendly solutions that cater to a broader audience. Furthermore, studies indicate that organizations with strong data-driven cultures are 5 times more likely to make faster decisions than their competitors, underscoring the importance of integrating data discovery into everyday business practices.

Rising Demand for Real-Time Analytics

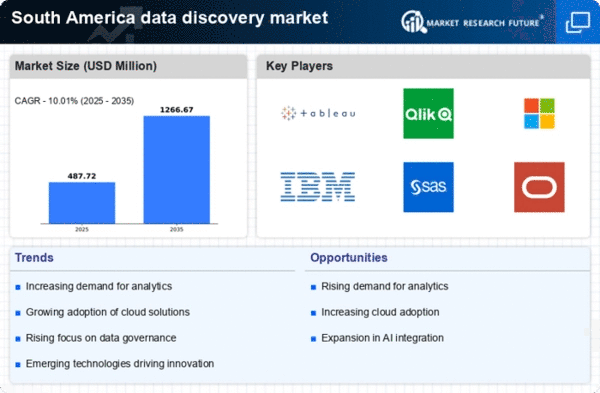

The data discovery market in South America experiences a notable surge in demand for real-time analytics. Businesses increasingly recognize the necessity of immediate insights to drive decision-making processes. This trend is particularly pronounced in sectors such as finance and retail, where timely data can significantly influence operational efficiency and customer satisfaction. According to recent estimates, the market for real-time analytics in South America is projected to grow at a CAGR of approximately 25% over the next five years. This growth is likely to propel the data discovery market, as organizations seek tools that facilitate rapid data processing and visualization, enabling them to respond swiftly to market changes.

Technological Advancements in Data Processing

Technological advancements play a pivotal role in shaping the data discovery market in South America. Innovations in machine learning, natural language processing, and big data technologies are enhancing the capabilities of data discovery tools. These advancements enable organizations to process vast amounts of data more efficiently, uncovering insights that were previously unattainable. As a result, the data discovery market is likely to witness increased adoption of sophisticated analytics platforms that leverage these technologies. The integration of advanced algorithms can lead to improved accuracy in data interpretation, ultimately driving better business outcomes and fostering a competitive edge in the marketplace.

Increased Investment in Business Intelligence Solutions

Investment in business intelligence (BI) solutions is on the rise in South America, significantly impacting the data discovery market. Organizations are recognizing the value of data-driven insights in enhancing operational efficiency and strategic planning. As a result, the data discovery market is experiencing a shift towards comprehensive BI platforms that integrate data visualization, reporting, and analytics capabilities. Recent reports suggest that the BI market in South America is expected to reach $5 billion by 2026, indicating a robust growth trajectory. This influx of investment is likely to drive innovation and competition within the data discovery market, as vendors strive to offer cutting-edge solutions that meet the evolving needs of businesses.