Emphasis on Data-Driven Culture

The emphasis on fostering a data-driven culture within organizations is significantly influencing the data discovery market in Europe. Companies are increasingly recognizing the importance of data literacy and empowering employees to make data-informed decisions. This cultural shift is driving the adoption of self-service data discovery tools that enable users across various departments to access and analyze data independently. As organizations invest in training and resources to promote data literacy, the market for user-friendly data discovery solutions is expected to expand. It is projected that by 2025, the demand for such tools could increase by 30%, reflecting the growing importance of data in organizational strategy.

Integration of Advanced Analytics

The integration of advanced analytics into the data discovery market is transforming how organizations leverage their data. Businesses are increasingly seeking tools that combine data discovery with predictive and prescriptive analytics capabilities. This trend is driven by the need for actionable insights that can inform strategic decision-making. As organizations recognize the value of data-driven strategies, the market for integrated analytics solutions is anticipated to grow significantly. It is estimated that by 2026, the market for advanced analytics in Europe could reach €10 billion, underscoring the importance of data discovery tools that facilitate this integration.

Rising Data Volume and Complexity

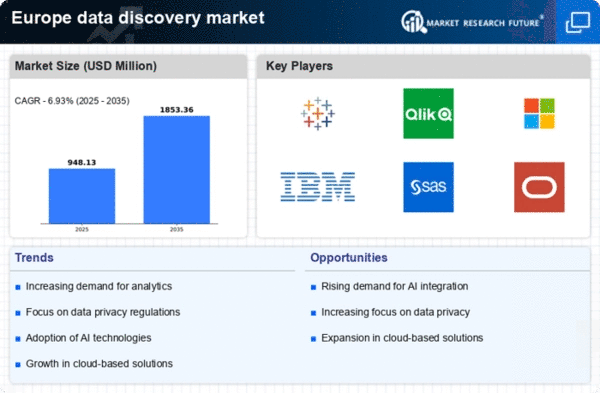

The data discovery market in Europe is experiencing a surge due to the exponential growth of data volume and complexity. Organizations are generating vast amounts of data from various sources, including IoT devices, social media, and transactional systems. This increase necessitates advanced data discovery tools to efficiently analyze and derive insights from complex datasets. According to recent estimates, the data generated in Europe is projected to reach 35 zettabytes by 2025, highlighting the urgent need for effective data management solutions. As businesses strive to harness this data for competitive advantage, the demand for innovative data discovery technologies is likely to escalate, driving market growth.

Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is a notable driver in the data discovery market in Europe. Organizations are increasingly adopting cloud technologies to enhance scalability, flexibility, and cost-effectiveness. Cloud-based data discovery tools enable businesses to access and analyze data from anywhere, fostering collaboration and real-time decision-making. This trend is reflected in the growing investment in cloud infrastructure, which is projected to reach €100 billion by 2025 in Europe. As companies migrate to the cloud, the demand for data discovery solutions that seamlessly integrate with cloud environments is likely to rise, further stimulating market growth.

Regulatory Compliance and Data Privacy

In the context of the data discovery market, regulatory compliance and data privacy are paramount. The implementation of stringent regulations, such as the General Data Protection Regulation (GDPR), has compelled organizations to adopt robust data discovery solutions. These tools assist in identifying, classifying, and managing personal data, ensuring compliance with legal requirements. The market for data discovery solutions is expected to grow by approximately 20% annually as companies prioritize data governance and privacy measures. This focus on compliance not only mitigates risks but also enhances customer trust, further propelling the demand for data discovery technologies.