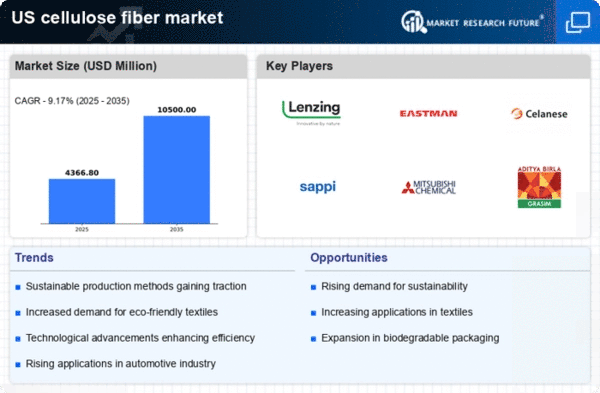

The cellulose fiber market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable materials and innovations in production technologies. Key players such as Lenzing AG (Austria), Eastman Chemical Company (US), and Celanese Corporation (US) are strategically positioning themselves to capitalize on these trends. Lenzing AG (Austria) focuses on sustainability and has been enhancing its product portfolio with eco-friendly fibers, which aligns with the growing consumer preference for sustainable textiles. Eastman Chemical Company (US) emphasizes innovation in its cellulose-based products, aiming to expand its market share through advanced manufacturing processes. Celanese Corporation (US) is also investing in research and development to improve the performance of its cellulose fibers, thereby enhancing its competitive edge in the market.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of these key players is significant, as they drive technological advancements and set industry standards that smaller companies often follow.

In October Lenzing AG (Austria) announced a partnership with a leading fashion brand to develop a new line of sustainable clothing made from TENCEL™ fibers. This collaboration not only reinforces Lenzing's commitment to sustainability but also enhances its visibility in the fashion industry, potentially attracting environmentally conscious consumers. The strategic importance of this partnership lies in its ability to leverage Lenzing's innovative fiber technology while addressing the growing demand for sustainable fashion.

In September Eastman Chemical Company (US) launched a new cellulose acetate product designed for use in high-performance applications. This product is expected to meet the increasing demand for biodegradable materials in various industries, including packaging and textiles. The introduction of this innovative product underscores Eastman's focus on sustainability and positions the company as a leader in the development of eco-friendly materials, which could significantly enhance its market presence.

In August Celanese Corporation (US) expanded its production capacity for cellulose fibers in response to rising demand. This expansion is strategically important as it allows Celanese to better serve its customers and respond to market needs more effectively. By increasing production capacity, Celanese aims to solidify its position in the cellulose fiber market and enhance its competitive advantage through improved supply chain reliability.

As of November the cellulose fiber market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. These trends are reshaping the competitive landscape, with companies increasingly forming strategic alliances to enhance their capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to changing consumer preferences, particularly in the realm of sustainability.