Growth in the Textile Industry

The textile industry is experiencing a notable expansion, which positively influences the Global Cellulose Acetate Market Industry. Cellulose acetate is widely used in the production of fibers for clothing and home textiles due to its desirable properties, such as softness and luster. As fashion trends evolve and consumer preferences shift towards high-quality, sustainable fabrics, the demand for cellulose acetate fibers is likely to increase. This trend is reflected in the projected growth of the market, which is expected to reach 10.5 USD Billion by 2035. The textile sector's growth, coupled with cellulose acetate's unique attributes, positions the market for sustained expansion.

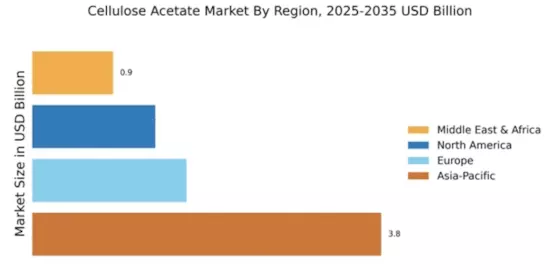

Market Trends and Growth Projections

The Global Cellulose Acetate Market Industry is witnessing a dynamic landscape characterized by evolving consumer preferences and market trends. The projected growth from 6.7 USD Billion in 2024 to 10.5 USD Billion by 2035 indicates a robust market trajectory. Factors such as increasing awareness of environmental issues, technological advancements, and the expansion of application sectors are contributing to this growth. The anticipated compound annual growth rate of 4.18% from 2025 to 2035 further underscores the market's potential. These trends suggest a promising future for cellulose acetate, positioning it as a key player in the transition towards sustainable materials across various industries.

Technological Advancements in Production

Technological advancements in the production processes of cellulose acetate are enhancing efficiency and reducing costs, thereby benefiting the Global Cellulose Acetate Market Industry. Innovations such as improved extraction methods and the development of more efficient manufacturing techniques contribute to higher yields and lower environmental impact. These advancements not only make cellulose acetate more accessible but also align with the growing demand for sustainable materials. As production becomes more streamlined, the market is likely to see an increase in adoption across various sectors, further supporting its growth trajectory. This is particularly relevant as the market anticipates a compound annual growth rate of 4.18% from 2025 to 2035.

Rising Demand for Biodegradable Materials

The increasing global emphasis on sustainability and environmental conservation drives the demand for biodegradable materials, including cellulose acetate. As consumers and industries seek eco-friendly alternatives to traditional plastics, the Global Cellulose Acetate Market Industry is poised to benefit significantly. The material's biodegradability and non-toxic properties align with regulatory trends favoring sustainable practices. For instance, cellulose acetate is utilized in various applications, such as packaging and textiles, which are under scrutiny for their environmental impact. This shift towards greener materials is expected to propel the market's growth, contributing to its projected value of 6.7 USD Billion in 2024.

Regulatory Support for Sustainable Materials

Regulatory frameworks globally are increasingly favoring the use of sustainable materials, which is a key driver for the Global Cellulose Acetate Market Industry. Governments are implementing policies that encourage the adoption of biodegradable and environmentally friendly materials in various sectors, including packaging, textiles, and automotive. This regulatory support not only enhances the market's attractiveness but also incentivizes manufacturers to invest in cellulose acetate production. As these policies gain traction, the market is expected to experience accelerated growth, aligning with the global shift towards sustainability. This trend is likely to play a crucial role in achieving the projected market value of 10.5 USD Billion by 2035.

Increasing Applications in the Automotive Sector

The automotive sector is increasingly recognizing the benefits of cellulose acetate, which is driving its adoption within the Global Cellulose Acetate Market Industry. This material is utilized in various automotive components, including interior parts and filters, due to its lightweight and durable characteristics. As manufacturers strive to enhance fuel efficiency and reduce emissions, the demand for lightweight materials like cellulose acetate is likely to rise. This trend is indicative of a broader movement towards sustainable practices in the automotive industry, which could further bolster the market's growth. The integration of cellulose acetate into automotive applications may contribute significantly to the market's projected value.