Increased Healthcare Expenditure

The rising healthcare expenditure in the US is significantly impacting the cardiac implants market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced medical technologies, including cardiac implants. This increase in funding allows for the development and adoption of innovative devices that can improve patient outcomes. Additionally, as more patients gain access to health insurance, the demand for cardiac procedures is likely to rise. The cardiac implants market is expected to benefit from this trend, as healthcare providers seek to offer cutting-edge solutions to meet the needs of their patients. Furthermore, the emphasis on value-based care is encouraging hospitals to invest in high-quality implants that can lead to better long-term health outcomes, thereby driving market growth.

Aging Population and Lifestyle Changes

The aging population in the US, coupled with lifestyle changes, is a significant driver of the cardiac implants market. As individuals age, the risk of developing cardiovascular diseases increases, leading to a higher demand for cardiac interventions. The US Census Bureau projects that by 2030, all baby boomers will be over 65 years old, resulting in a substantial increase in the elderly population. Concurrently, lifestyle factors such as poor diet, lack of exercise, and increased stress levels contribute to the prevalence of heart-related conditions. This demographic shift is likely to create a greater need for cardiac implants, as healthcare providers seek to address the growing burden of cardiovascular diseases. The cardiac implants market is poised for growth, with estimates suggesting a potential market size of $45 billion by 2026, driven by these demographic and lifestyle trends.

Enhanced Patient Awareness and Education

Enhanced patient awareness and education regarding cardiovascular health are emerging as vital drivers of the cardiac implants market. As patients become more informed about the risks associated with heart disease and the available treatment options, they are more likely to seek medical intervention. Initiatives by healthcare organizations and advocacy groups are promoting awareness campaigns that educate the public about the importance of early detection and treatment of cardiovascular conditions. This increased awareness is likely to lead to higher rates of diagnosis and, consequently, a greater demand for cardiac implants. The cardiac implants market is expected to benefit from this trend, as more patients actively engage in their healthcare decisions. Furthermore, the emphasis on shared decision-making between patients and healthcare providers may result in a more tailored approach to treatment, further driving the adoption of cardiac implants.

Technological Innovations in Implant Design

Technological advancements in the design and functionality of cardiac implants are transforming the landscape of the cardiac implants market. Innovations such as bioresorbable stents, advanced pacemakers, and implantable cardioverter-defibrillators (ICDs) are enhancing patient outcomes and driving market growth. The integration of smart technology into these devices allows for real-time monitoring and data collection, which can lead to improved patient management. Furthermore, the development of minimally invasive surgical techniques is reducing recovery times and hospital stays, making these procedures more appealing to patients. As a result, the cardiac implants market is experiencing a surge in demand, with projections indicating a market value exceeding $50 billion by 2027. This trend suggests that ongoing research and development will continue to play a crucial role in shaping the future of cardiac care.

Rising Prevalence of Cardiovascular Diseases

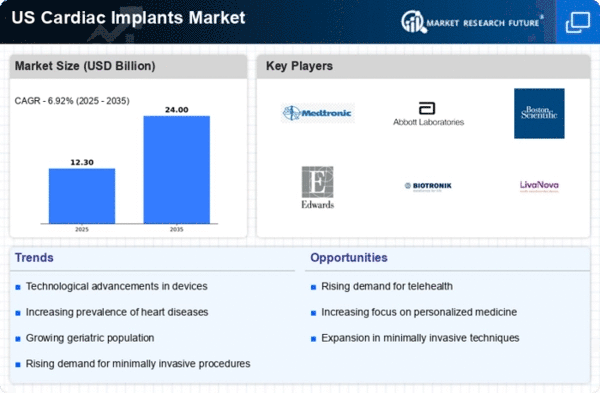

The increasing incidence of cardiovascular diseases in the US is a primary driver for the cardiac implants market. According to the CDC, heart disease remains the leading cause of death, accounting for approximately 697,000 deaths annually. This alarming statistic underscores the urgent need for effective treatment options, including cardiac implants. As the population ages, the prevalence of conditions such as coronary artery disease and heart failure is expected to rise, further propelling demand for innovative cardiac devices. the cardiac implants market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 6.92% over the next several years. This growth is likely to be fueled by advancements in implant technology and increased awareness of treatment options among healthcare providers and patients alike.