Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is fostering growth in the cardiac implants market. As governments and private entities invest more in healthcare, there is a corresponding rise in the availability of advanced medical technologies, including cardiac implants. Reports indicate that healthcare spending in several South American countries has been on an upward trajectory, with projections suggesting a growth rate of approximately 5% annually. This financial commitment is likely to enhance the cardiac implants market, as hospitals and clinics are better equipped to procure and implement innovative cardiac solutions. Consequently, patients may experience improved access to life-saving treatments, further driving market expansion.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in South America are significantly impacting the cardiac implants market. Various countries in the region are allocating funds to enhance cardiac care facilities and promote the adoption of advanced medical technologies. For instance, public health programs are increasingly focusing on preventive care and early intervention strategies, which include the use of cardiac implants. This proactive approach is expected to drive the growth of the cardiac implants market, as more patients gain access to necessary treatments. Additionally, partnerships between governments and private sectors may further bolster research and development efforts, leading to innovative solutions in cardiac care.

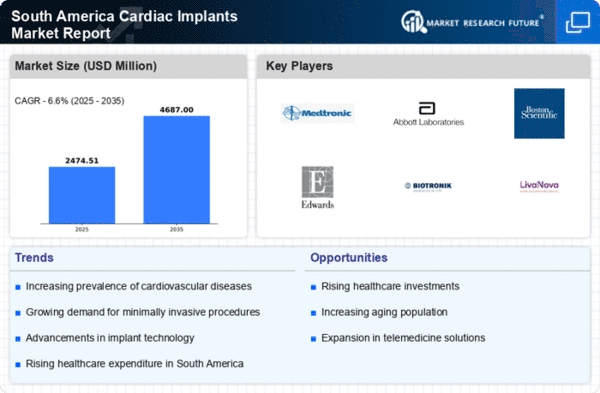

Increasing Cardiovascular Diseases

The rising incidence of cardiovascular diseases in South America is a primary driver for the cardiac implants market. According to health statistics, cardiovascular diseases account for a significant portion of mortality in the region, with estimates suggesting that they contribute to over 30% of all deaths. This alarming trend necessitates advanced medical interventions, including cardiac implants, to manage and treat these conditions effectively. As healthcare systems strive to address this growing burden, investments in cardiac implant technologies are likely to increase. The cardiac implants market is expected to expand as hospitals and clinics enhance their capabilities to provide life-saving treatments, thereby improving patient outcomes and quality of life.

Aging Population and Healthcare Demand

The demographic shift towards an aging population in South America is a crucial factor influencing the cardiac implants market. As the population ages, the prevalence of age-related cardiovascular conditions is likely to rise, leading to increased demand for cardiac implants. Projections indicate that by 2030, the elderly population in South America will constitute a significant portion of the total demographic, thereby intensifying the need for specialized cardiac care. The cardiac implants market is poised to benefit from this trend, as healthcare providers adapt to meet the growing needs of older patients. This demographic change may also prompt further investment in research and development to create tailored solutions for this population.

Technological Innovations in Cardiac Devices

Technological advancements in cardiac devices are propelling the cardiac implants market in South America. Innovations such as bioresorbable stents, advanced pacemakers, and implantable cardioverter-defibrillators (ICDs) are becoming increasingly prevalent. These devices not only enhance patient safety but also improve the efficacy of treatments. The cardiac implants market is witnessing a surge in demand for these cutting-edge technologies, as they offer minimally invasive options and shorter recovery times. Furthermore, the integration of telemedicine and remote monitoring capabilities into these devices is likely to enhance patient management, making them more appealing to healthcare providers and patients alike.