Consumer Awareness and Education

The growing awareness and education regarding the benefits of bio-based products are crucial drivers for the US Bio-Based Surfactants Market. As consumers become more informed about the environmental and health advantages of bio-based surfactants, their purchasing decisions are increasingly influenced by these factors. Educational campaigns and marketing strategies that highlight the advantages of bio-based surfactants are likely to enhance consumer trust and drive demand. Market Research Future indicates that consumers are willing to pay a premium for products that are perceived as environmentally friendly, which could lead to a substantial increase in market share for bio-based surfactants in various sectors, including personal care and household cleaning.

Innovations in Production Technologies

Technological advancements in the production of bio-based surfactants are significantly influencing the US Bio-Based Surfactants Market. Innovations such as enzymatic processes and fermentation technology are enhancing the efficiency and cost-effectiveness of bio-surfactant production. For instance, recent developments have led to the creation of surfactants that are not only effective but also produced with lower energy inputs. This is crucial as the market is expected to reach a valuation of over USD 1 billion by 2026, driven by these innovations. Furthermore, the ability to produce bio-based surfactants at scale is likely to attract more manufacturers, thereby expanding the market and increasing competition.

Rising Demand for Eco-Friendly Products

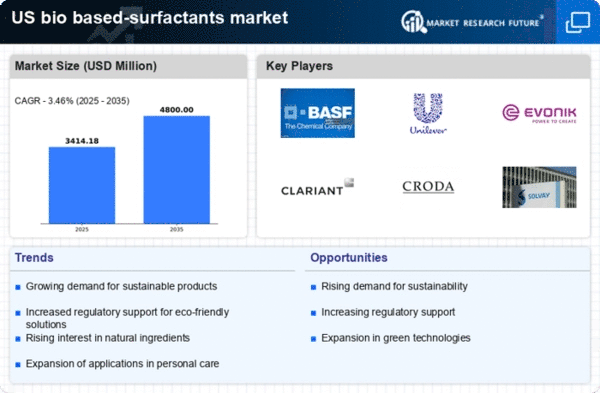

The increasing consumer preference for eco-friendly products is a pivotal driver for the US Bio-Based Surfactants Market. As awareness of environmental issues grows, consumers are gravitating towards products that are biodegradable and derived from renewable resources. This shift is reflected in market data, indicating that the demand for bio-based surfactants is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. Companies are responding by reformulating their products to include bio-based ingredients, thereby enhancing their market appeal. This trend not only aligns with consumer values but also positions companies favorably in a competitive landscape where sustainability is becoming a key differentiator.

Regulatory Incentives for Bio-Based Products

Regulatory frameworks supporting the use of bio-based products are emerging as a significant driver for the US Bio-Based Surfactants Market. Government initiatives aimed at promoting sustainable practices are encouraging manufacturers to adopt bio-based alternatives. For example, the Environmental Protection Agency (EPA) has established guidelines that favor the use of bio-based materials in various applications. This regulatory support not only facilitates market entry for new players but also incentivizes existing companies to transition towards bio-based surfactants. As a result, the market is likely to witness an influx of innovative products that comply with these regulations, further propelling growth.

Shift Towards Sustainable Manufacturing Practices

The transition towards sustainable manufacturing practices is a notable driver for the US Bio-Based Surfactants Market. Manufacturers are increasingly adopting practices that minimize environmental impact, such as reducing waste and utilizing renewable resources. This shift is not only driven by consumer demand but also by corporate responsibility initiatives aimed at enhancing brand reputation. As companies strive to meet sustainability goals, the incorporation of bio-based surfactants into their product lines is becoming more prevalent. This trend is expected to contribute to a robust growth trajectory for the market, as businesses recognize the long-term benefits of sustainable practices in terms of cost savings and consumer loyalty.