Supportive Regulatory Frameworks

The establishment of supportive regulatory frameworks is a significant driver for the Bio-Based Chemicals Market. Governments across various regions are implementing policies that promote the use of bio-based chemicals, often through incentives and subsidies. For example, regulations that mandate the reduction of greenhouse gas emissions are encouraging industries to transition towards bio-based alternatives. Market data suggests that regions with stringent environmental regulations are witnessing a faster adoption of bio-based chemicals, as companies seek compliance while enhancing their sustainability profiles. This regulatory support not only facilitates market entry for bio-based products but also encourages research and development, thereby bolstering the Bio-Based Chemicals Market.

Innovations in Production Technologies

Technological advancements in production processes are playing a crucial role in shaping the Bio-Based Chemicals Market. Innovations such as fermentation technology and enzymatic processes are enhancing the efficiency and cost-effectiveness of bio-based chemical production. For instance, recent developments in biocatalysis have shown potential to reduce production costs by up to 30%, making bio-based chemicals more competitive with their fossil fuel counterparts. Furthermore, the integration of digital technologies, such as artificial intelligence and machine learning, is streamlining operations and optimizing resource utilization. These innovations not only improve the economic viability of bio-based chemicals but also contribute to a more sustainable production framework, thereby fostering growth in the Bio-Based Chemicals Market.

Rising Demand for Sustainable Products

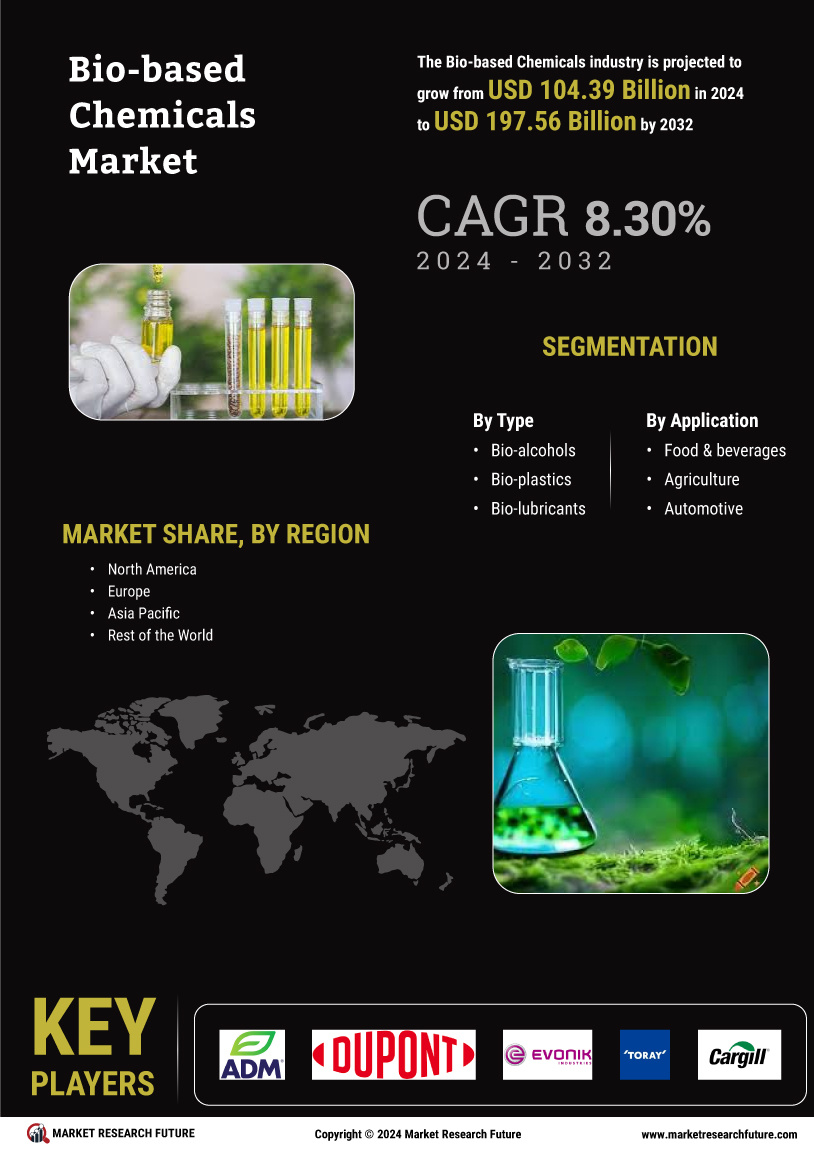

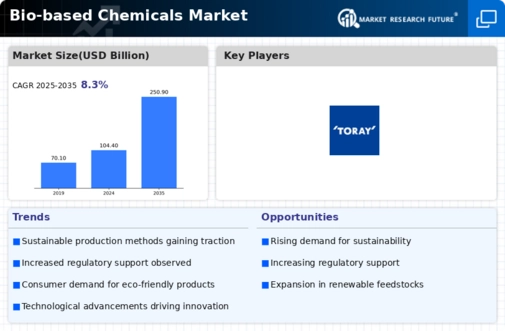

The increasing consumer awareness regarding environmental issues appears to drive the demand for sustainable products, thereby influencing the Bio-Based Chemicals Market. As consumers become more conscious of their purchasing decisions, they tend to favor products derived from renewable resources over traditional petrochemical-based alternatives. This shift is reflected in market data, which indicates that the bio-based chemicals segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. Companies are responding to this trend by investing in bio-based alternatives, which not only meet consumer preferences but also align with corporate sustainability goals. Consequently, the rising demand for sustainable products is likely to propel the Bio-Based Chemicals Market forward.

Growing Investment in Renewable Resources

The increasing investment in renewable resources is significantly impacting the Bio-Based Chemicals Market. Investors are recognizing the long-term potential of bio-based chemicals as a sustainable alternative to traditional petrochemicals. Recent reports indicate that venture capital funding for bio-based startups has surged, with investments reaching over 1 billion dollars in the past year alone. This influx of capital is enabling companies to scale their operations and innovate new products, thereby expanding the market. Additionally, partnerships between established chemical companies and startups are fostering knowledge transfer and accelerating the commercialization of bio-based technologies. As a result, the growing investment in renewable resources is likely to enhance the competitiveness of the Bio-Based Chemicals Market.

Consumer Preference for Eco-Friendly Solutions

The shift in consumer preference towards eco-friendly solutions is a pivotal driver for the Bio-Based Chemicals Market. As environmental concerns become more pronounced, consumers are actively seeking products that minimize ecological impact. This trend is evident in various sectors, including personal care, packaging, and automotive, where bio-based chemicals are increasingly favored. Market analysis indicates that products containing bio-based ingredients are experiencing higher sales growth compared to conventional products. Companies are responding to this demand by reformulating their offerings to include bio-based alternatives, thereby enhancing their market appeal. Consequently, the consumer preference for eco-friendly solutions is expected to continue driving growth in the Bio-Based Chemicals Market.