Enhanced Safety Regulations

The automotive chip market is significantly influenced by stringent safety regulations imposed by government authorities. These regulations mandate the integration of advanced safety features in vehicles, such as collision avoidance systems and automated braking. As a result, the demand for high-performance chips that can process data from various sensors is increasing. In 2025, it is projected that the market for automotive safety chips will reach $10 billion in the US, driven by the need for compliance with safety standards. This regulatory environment compels manufacturers to prioritize the development of reliable and efficient semiconductor solutions, thereby propelling the automotive chip market forward.

Rising Vehicle Electrification

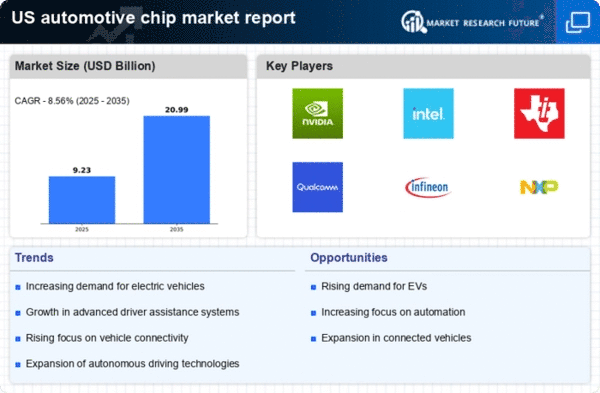

The automotive chip market is experiencing a notable surge due to the increasing electrification of vehicles. As manufacturers pivot towards electric vehicles (EVs), the demand for specialized chips that manage battery systems, power distribution, and energy efficiency is escalating. In 2025, it is estimated that EVs will account for approximately 25% of new vehicle sales in the US, necessitating advanced semiconductor solutions. This shift not only enhances vehicle performance but also aligns with regulatory pressures for reduced emissions. Consequently, the automotive chip market is poised for growth as companies invest in innovative technologies to support this transition.

Growth of Autonomous Vehicle Technology

The automotive chip market is poised for growth due to the burgeoning development of autonomous vehicle technology. As companies invest heavily in research and development to create self-driving capabilities, the demand for sophisticated chips that can process vast amounts of data in real-time is increasing. By 2025, the market for chips used in autonomous vehicles is projected to reach $12 billion in the US. This growth is indicative of the industry's commitment to advancing automation, which necessitates the integration of high-performance semiconductor solutions. Thus, the automotive chip market is likely to thrive as it adapts to the evolving landscape of vehicle automation.

Consumer Preference for Connected Vehicles

The automotive chip market is increasingly driven by consumer preferences for connected vehicles. As drivers seek enhanced connectivity features, such as in-car infotainment systems and vehicle-to-everything (V2X) communication, the demand for advanced chips is rising. In 2025, it is anticipated that the market for connectivity solutions in vehicles will exceed $15 billion in the US. This trend underscores the necessity for manufacturers to integrate high-performance chips that support seamless connectivity. Consequently, the automotive chip market is likely to expand as companies innovate to meet consumer expectations for integrated technology.

Technological Advancements in Automotive Electronics

The automotive chip market is benefiting from rapid technological advancements in automotive electronics. Innovations in artificial intelligence (AI) and machine learning are enabling the development of smarter chips that enhance vehicle functionality. These advancements facilitate features such as real-time data processing and predictive maintenance, which are becoming essential in modern vehicles. By 2025, the market for AI-driven automotive chips is expected to grow by 30%, reflecting the industry's shift towards more intelligent systems. This trend indicates a robust demand for sophisticated semiconductor solutions, positioning the automotive chip market for substantial growth.