Geopolitical Tensions

Geopolitical tensions in various regions have a profound impact on the US Armoured Personnel Carrier Market. The ongoing conflicts and potential threats from adversarial nations necessitate a robust military presence and readiness. The US military's involvement in international peacekeeping and conflict resolution efforts has led to an increased demand for armored personnel carriers that can operate in diverse environments. For instance, the US has deployed armored units in Eastern Europe to deter aggression, highlighting the need for reliable and mobile personnel carriers. This geopolitical landscape suggests that the US Armoured Personnel Carrier Market will continue to thrive as defense strategies adapt to emerging global challenges.

Technological Innovations

Technological innovations play a pivotal role in shaping the US Armoured Personnel Carrier Market. The integration of advanced technologies such as artificial intelligence, autonomous systems, and enhanced armor materials is revolutionizing the design and functionality of armored vehicles. The US military is investing in research and development to create next-generation personnel carriers that offer improved survivability and operational efficiency. For example, the introduction of hybrid propulsion systems is expected to enhance mobility while reducing logistical burdens. As these innovations become more prevalent, they are likely to drive demand within the US Armoured Personnel Carrier Market, fostering a competitive landscape among manufacturers.

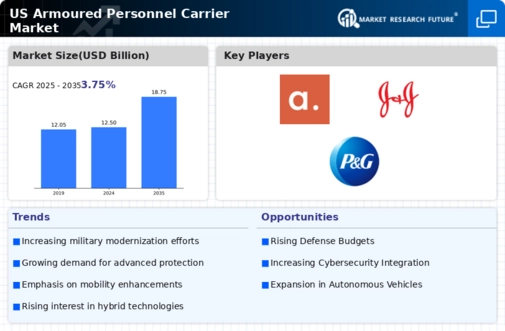

Rising Military Expenditure

The US Armoured Personnel Carrier Market is experiencing a notable surge in military expenditure, driven by the need for enhanced defense capabilities. The US government has allocated substantial budgets for modernization and procurement of advanced armored vehicles. In fiscal year 2025, the Department of Defense reported a budget increase of approximately 5% for ground combat systems, which includes armored personnel carriers. This financial commitment reflects a strategic focus on maintaining military readiness and ensuring that armed forces are equipped with state-of-the-art technology. As threats evolve, the demand for versatile and resilient armored personnel carriers is likely to grow, positioning the US Armoured Personnel Carrier Market for sustained expansion.

Increased Focus on Urban Warfare

The evolving nature of warfare, particularly the shift towards urban environments, is influencing the US Armoured Personnel Carrier Market. Urban warfare presents unique challenges, necessitating vehicles that can navigate confined spaces while providing adequate protection for troops. The US military is adapting its strategies to address these challenges, leading to a demand for armored personnel carriers designed specifically for urban operations. This trend is evident in recent military exercises that emphasize urban combat scenarios, underscoring the need for versatile and agile vehicles. Consequently, manufacturers are likely to respond to this demand by developing specialized armored personnel carriers tailored for urban warfare, thereby enhancing the market's growth prospects.

Collaborative Defense Initiatives

Collaborative defense initiatives between the US government and private sector companies are significantly impacting the US Armoured Personnel Carrier Market. Public-private partnerships are fostering innovation and efficiency in the development of armored vehicles. The US military has engaged in various collaborative programs aimed at enhancing the capabilities of personnel carriers, such as the Joint Light Tactical Vehicle program, which emphasizes modularity and adaptability. These initiatives not only streamline the procurement process but also encourage the integration of cutting-edge technologies. As collaboration continues to flourish, the US Armoured Personnel Carrier Market is poised for growth, driven by the combined expertise of government and industry stakeholders.