Geopolitical Considerations

Geopolitical considerations play a significant role in shaping the Argentina armored personnel carrier market. The regional security landscape has prompted the Argentine government to reassess its defense posture, leading to increased investments in military capabilities. Tensions in neighboring countries and the need for border security have underscored the importance of a robust armored personnel carrier fleet. As a result, the government is likely to prioritize the procurement of advanced vehicles that can effectively address these challenges. This geopolitical context not only drives demand for armored personnel carriers but also influences the types of technologies and features that are sought after. The Argentina armored personnel carrier market may experience growth as defense budgets are adjusted to reflect these strategic imperatives, ensuring that the military is equipped to respond to potential threats.

Focus on Indigenous Production

A pronounced focus on indigenous production is emerging as a significant driver within the Argentina armored personnel carrier market. The Argentine government has been actively promoting local manufacturing capabilities to reduce reliance on foreign suppliers. This initiative aligns with national policies aimed at fostering economic growth and technological advancement. By investing in local defense industries, Argentina aims to create jobs and stimulate economic activity. Recent reports suggest that local manufacturers are increasingly capable of producing armored personnel carriers that meet international standards. This shift not only enhances national security but also positions the Argentina armored personnel carrier market as a competitive player in the regional defense sector. The emphasis on indigenous production may also lead to innovations tailored to the specific needs of the Argentine military, further solidifying the market's growth potential.

Modernization of Military Fleet

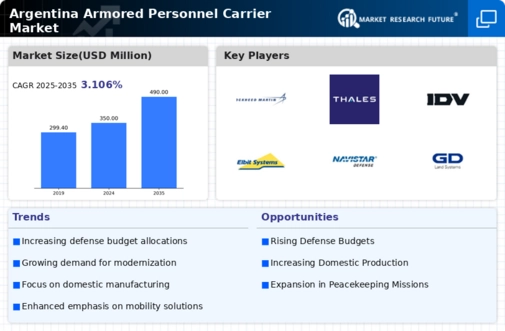

The modernization of the military fleet in Argentina is a pivotal driver for the Argentina armored personnel carrier market. The Argentine government has recognized the necessity to upgrade its defense capabilities, particularly in light of regional security dynamics. Recent allocations in the national budget indicate a commitment to enhancing military infrastructure, with a focus on acquiring advanced armored personnel carriers. This modernization effort is not merely about replacing outdated vehicles; it encompasses the integration of cutting-edge technology to improve operational efficiency. The Argentina armored personnel carrier market is likely to benefit from this trend, as the demand for modernized vehicles increases. Furthermore, the government has initiated partnerships with local manufacturers to bolster domestic production, which may lead to a more robust supply chain and reduced dependency on foreign imports.

Integration of Advanced Technologies

The integration of advanced technologies into armored personnel carriers is a crucial driver for the Argentina armored personnel carrier market. As military operations evolve, the demand for vehicles equipped with state-of-the-art technology has surged. This includes enhancements in communication systems, surveillance capabilities, and defensive measures. The Argentine military is increasingly prioritizing the acquisition of vehicles that incorporate these advanced features, which are essential for modern warfare. Recent procurement strategies indicate a shift towards vehicles that not only provide mobility but also enhance situational awareness and combat effectiveness. The Argentina armored personnel carrier market stands to gain from this trend, as manufacturers are compelled to innovate and adapt their offerings to meet the military's evolving requirements. This technological integration may also foster collaborations between defense contractors and technology firms, potentially leading to groundbreaking advancements.

International Collaboration and Defense Partnerships

International collaboration and defense partnerships are emerging as vital drivers for the Argentina armored personnel carrier market. The Argentine government has been actively seeking partnerships with foreign defense manufacturers to enhance its military capabilities. These collaborations often involve technology transfer agreements, which can significantly bolster local production capabilities. Recent discussions with international defense firms suggest a willingness to invest in joint ventures that focus on the development of armored personnel carriers tailored to the specific needs of the Argentine military. Such partnerships not only facilitate access to advanced technologies but also promote knowledge sharing and skill development within the local workforce. The Argentina armored personnel carrier market is likely to benefit from these international alliances, as they can lead to the introduction of innovative designs and improved production processes, ultimately enhancing the overall defense posture of the nation.