Rising Military Expenditure

The anti sniper-detection-system market experiences growth due to increasing military budgets in the US. The Department of Defense has allocated substantial funds to enhance national security, with a focus on advanced technologies. In 2025, military spending is projected to reach approximately $800 billion, reflecting a 5% increase from the previous year. This financial commitment underscores the importance of investing in systems that can detect and neutralize sniper threats. As military operations become more complex, the demand for sophisticated anti sniper-detection systems is likely to rise, driving innovation and competition within the industry. Furthermore, the emphasis on modernization initiatives within the armed forces suggests a sustained interest in acquiring cutting-edge technologies that can provide a tactical advantage in combat scenarios.

Emerging Private Security Sector

The anti sniper-detection-system market is also influenced by the growth of the private security sector in the US. As businesses and high-profile individuals seek to protect their assets and personnel, the demand for advanced security solutions is on the rise. The private security industry is projected to reach a valuation of $350 billion by 2026, indicating a robust market for anti sniper-detection systems. This trend suggests that private entities are increasingly recognizing the value of investing in sophisticated detection technologies to mitigate risks associated with sniper attacks. As the lines between public and private security continue to blur, the anti sniper-detection-system market may see increased collaboration between government agencies and private security firms, fostering innovation and expanding market reach.

Heightened Urban Security Concerns

The anti sniper detection system market is influenced by growing concerns regarding urban security in the US. With an increase in urbanization, cities are becoming more vulnerable to sniper attacks, prompting law enforcement agencies to seek advanced detection systems. Reports indicate that urban areas account for over 70% of the US population, creating a pressing need for effective security measures. As public safety becomes a priority, municipalities are investing in technologies that can mitigate risks associated with sniper threats. This trend is likely to drive demand for anti sniper-detection systems, as cities aim to protect citizens and critical infrastructure. The integration of these systems into urban security frameworks may enhance situational awareness and response capabilities, further solidifying their role in the industry.

Increased Focus on Counter-Terrorism

The anti sniper-detection-system market is significantly impacted by the heightened focus on counter-terrorism efforts in the US. As threats from domestic and international terrorist organizations persist, security agencies are prioritizing the development and deployment of advanced detection systems. The US government has allocated over $20 billion annually for counter-terrorism initiatives, emphasizing the need for effective tools to combat sniper threats. This financial commitment is likely to stimulate growth in the anti sniper-detection-system market, as agencies seek to enhance their operational capabilities. The integration of these systems into counter-terrorism strategies may provide a critical advantage in identifying and neutralizing potential threats, thereby reinforcing national security.

Technological Integration and Innovation

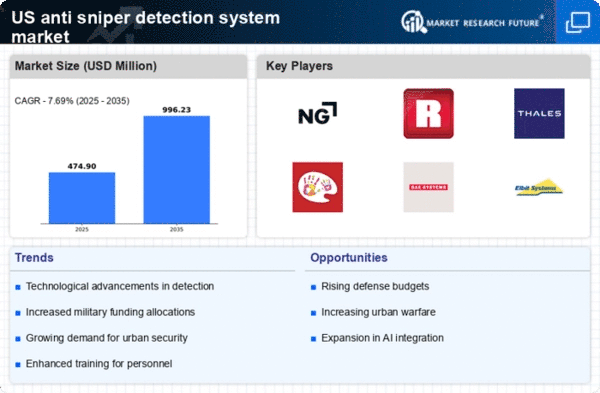

The anti sniper detection system market is propelled by the ongoing integration of innovative technologies. Advancements in sensor technology, artificial intelligence, and data analytics are transforming the capabilities of detection systems. In 2025, the market is expected to witness a growth rate of approximately 8%, driven by the adoption of smart technologies that enhance detection accuracy and response times. The ability to integrate these systems with existing military and law enforcement infrastructure is crucial for maximizing their effectiveness. As agencies seek to modernize their operations, the demand for anti sniper-detection systems that can seamlessly interface with other technologies is likely to increase. This trend indicates a shift towards more comprehensive security solutions that leverage cutting-edge innovations to address evolving threats.