Research Methodology on Acrylic Resins Market

Introduction

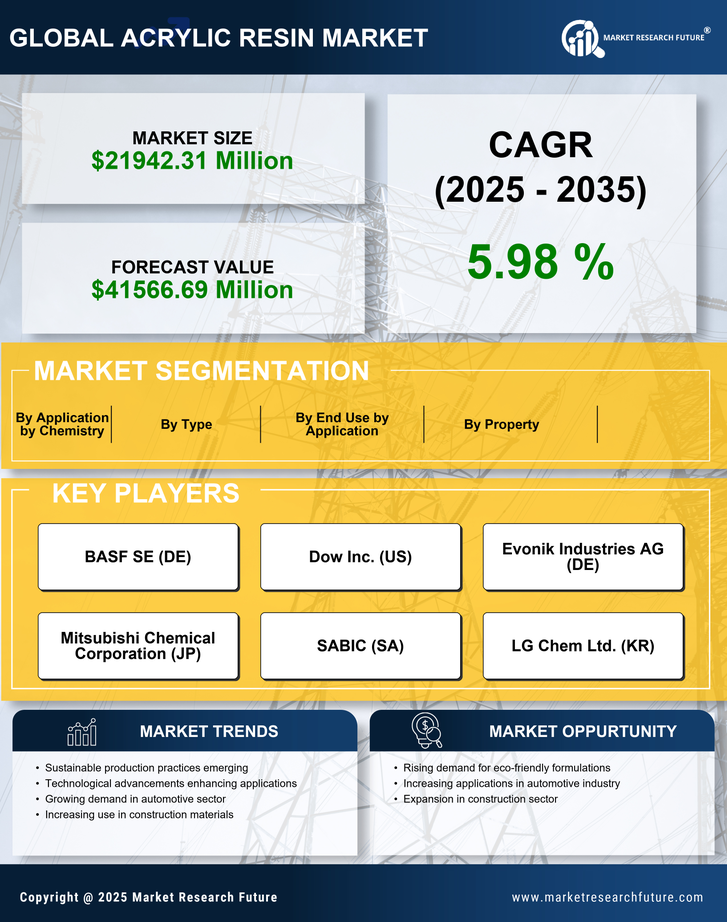

Acrylic resins are a type of synthetic polymer made up of derivatives of acrylic monomers, such as acrylic acid and methyl acrylate. These resins are widely used in various industries such as building & construction, automotive, paint & coating and adhesives, among others. The global acrylic resins market is forecasted to witness significant growth owing to their superior properties, such as superior toughness, scratch resistance, excellent adhesion and superior physical & chemical properties, which makes them appropriate for diverse applications.

Research Methodology

This study is a comprehensive examination of the global acrylic resins market. To provide in-depth insights into this market, the following research methodology is followed. The primary data-gathering process consists of extensive secondary research, backed by interviews with industry experts.

Secondary Research

Secondary research is conducted to provide a framework for the project. Due to its diverse applications, the extent of usage of acrylic resins is extremely wide. Extensive secondary research is conducted to understand the size and scope of the market as well as the key trends that indicate growth or decline. Secondary sources such as industry journals, online databases, government sources, trade publications and respected publications are used for data gathering.

Primary Research

Primary research is carried out to gain a better understanding of the market. Primary interviews are conducted to understand the current trends and future prospects of the market. Primary research is conducted by reaching out to industry experts, manufacturers, opinion leaders, suppliers, people involved in the value chain, end-users and stakeholders.

Data Collection

The organized and structured data collected through secondary and primary research is compiled, analyzed and presented in the form of market intelligence reports. The data sources used for this study include periodicals, industry documents, articles, journals, government documents, press releases, other databases and direct access to market players.

Analysis

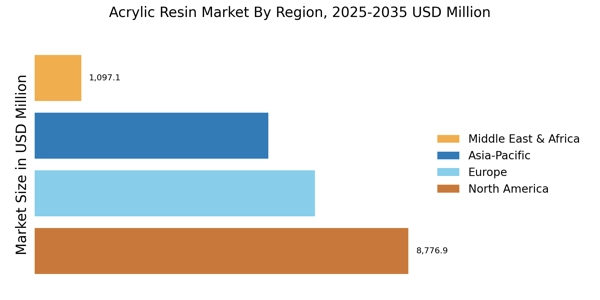

Analysis of the data collected from various sources is done to study the market and assess various aspects, such as market size, segmentation, Porter’s Five Force analysis and market trends. The data is analyzed to make inferences on various aspects, to identify the various stakeholders in the market and to provide insights into the key drivers and opportunities in the market.

Print and Online Interviews

Print and online interviews are conducted to understand the current state of the global rayon & staple fibres market and to determine the future prospects of the same. Primary interviews are carried out with market participants, industry experts, opinion leaders and other stakeholders.

Research Report

The research report provides an in-depth analysis of the key factors driving the growth of the acrylic resins market. It also provides insights into the major market trends and challenges, along with an overview of the prevailing competitive landscape and detailed profiles of the key players operating in the market. The report also assesses the current and future prospects of the market and presents projections of revenue potential over the forecasted period 2023 to 2030.

Conclusion

This comprehensive research methodology is used to provide an in-depth view of the global acrylic resin market. It helps to identify the various stakeholders in the market and understand their impact on the market dynamics. It also provides insights into the key drivers and opportunities in the market. The research focuses on understanding the market through secondary and primary research, interviews, analysis and data compilation. The research report provides an in-depth analysis of the major market trends, the competitive landscape and the growth potential of the acrylic resins market.