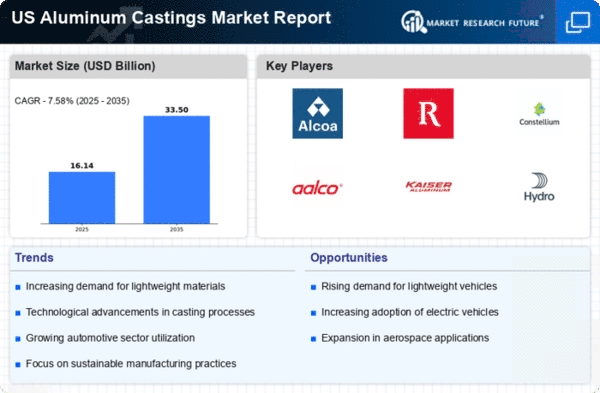

The aluminum castings market exhibits a dynamic competitive landscape characterized by innovation, sustainability, and strategic partnerships. Key players such as Alcoa (US), Kaiser Aluminum (US), and Constellium (NL) are actively shaping the market through various strategic initiatives. Alcoa (US) focuses on enhancing its production capabilities while investing in sustainable practices, which aligns with the growing demand for eco-friendly solutions. Kaiser Aluminum (US) emphasizes operational efficiency and product diversification, aiming to cater to a broader range of industries. Constellium (NL) leverages its expertise in advanced aluminum solutions, particularly in the automotive sector, to maintain a competitive edge. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and sustainability.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they set industry standards and drive innovation. Their collective efforts in streamlining operations and enhancing product offerings contribute to a more competitive landscape.

In October Alcoa (US) announced a partnership with a leading technology firm to develop advanced aluminum alloys aimed at the aerospace sector. This collaboration is expected to enhance Alcoa's product portfolio and position it as a leader in high-performance materials. The strategic importance of this move lies in its potential to capture a growing segment of the aerospace market, which increasingly demands lightweight and durable materials.

In September Kaiser Aluminum (US) unveiled a new manufacturing facility in the Midwest, designed to increase production capacity for automotive components. This expansion reflects Kaiser’s commitment to meeting the rising demand in the automotive sector, particularly for electric vehicles. The establishment of this facility is strategically significant as it not only boosts production capabilities but also enhances the company's regional presence, allowing for more efficient supply chain management.

In August Constellium (NL) secured a multi-year contract with a major automotive manufacturer to supply aluminum solutions for electric vehicles. This contract underscores Constellium's strategic focus on the growing electric vehicle market, which is anticipated to expand significantly in the coming years. The implications of this contract are profound, as it positions Constellium as a key player in a rapidly evolving industry, further solidifying its market presence.

As of November current competitive trends in the aluminum castings market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing operational efficiencies. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Companies are likely to differentiate themselves through innovative solutions and sustainable practices, which will be crucial for maintaining a competitive edge in the evolving market.