Growth in Air Travel

The aircraft fuel-nozzle market is poised for growth, largely due to the increasing volume of air travel in the US. With passenger numbers projected to rise significantly, airlines are expanding their fleets to accommodate this demand. This expansion necessitates the procurement of new aircraft, which in turn drives the need for advanced fuel-nozzle systems. The Federal Aviation Administration (FAA) has indicated that air travel in the US could increase by approximately 3.5% annually over the next decade. Consequently, this growth in air travel is expected to stimulate the aircraft fuel-nozzle market as manufacturers strive to meet the rising demand for efficient fuel delivery systems.

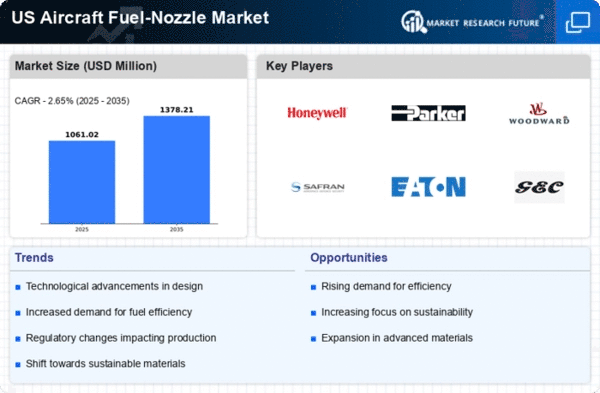

Rising Demand for Fuel Efficiency

The aircraft fuel-nozzle market is experiencing a notable surge in demand driven by the increasing emphasis on fuel efficiency among airlines. As fuel costs represent a significant portion of operational expenses, airlines are actively seeking technologies that enhance fuel economy. The integration of advanced fuel-nozzle designs can lead to improved combustion efficiency, thereby reducing fuel consumption. According to recent data, airlines in the US have reported a potential reduction in fuel costs by up to 15% through the adoption of innovative fuel-nozzle technologies. This trend is likely to propel the aircraft fuel-nozzle market as manufacturers respond to the need for more efficient solutions.

Increased Investment in Aerospace R&D

The aircraft fuel-nozzle market is benefiting from increased investment in aerospace research and development (R&D). As competition intensifies among manufacturers, there is a growing recognition of the need for innovative solutions to enhance fuel efficiency and performance. Government initiatives and private sector investments are channeling funds into R&D projects focused on advanced fuel-nozzle technologies. This influx of capital is likely to accelerate the development of next-generation fuel systems, which could transform the aircraft fuel-nozzle market. The emphasis on innovation is expected to yield products that not only meet current demands but also anticipate future industry needs.

Environmental Regulations and Standards

The aircraft fuel-nozzle market is increasingly shaped by stringent environmental regulations and standards aimed at reducing emissions. Regulatory bodies in the US are implementing measures that require airlines to adopt cleaner technologies to minimize their environmental footprint. This has led to a heightened focus on fuel efficiency and emissions reduction, prompting manufacturers to innovate and develop fuel-nozzle systems that comply with these regulations. The Environmental Protection Agency (EPA) has set ambitious targets for reducing greenhouse gas emissions from aviation, which could drive the aircraft fuel-nozzle market as companies seek to meet these compliance requirements.

Technological Innovations in Fuel Systems

The aircraft fuel-nozzle market is being significantly influenced by ongoing technological innovations in fuel systems. Advancements in materials and design methodologies are enabling the development of more efficient and reliable fuel-nozzle systems. For instance, the introduction of lightweight composite materials can enhance performance while reducing overall aircraft weight. Furthermore, the integration of smart technologies, such as sensors and data analytics, allows for real-time monitoring and optimization of fuel delivery. These innovations not only improve operational efficiency but also align with the industry's push towards sustainability, thereby positively impacting the aircraft fuel-nozzle market.