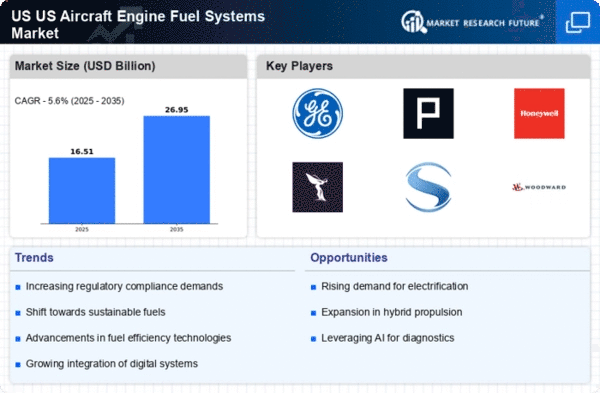

Growth of Military Aviation Sector

The US Aircraft Engine Fuel Systems Market is benefiting from the growth of the military aviation sector. Increased defense budgets and modernization programs are driving demand for advanced aircraft equipped with state-of-the-art fuel systems. The Department of Defense (DoD) is investing heavily in next-generation fighter jets and transport aircraft, which require sophisticated fuel management systems to enhance operational efficiency. This trend is expected to bolster the market as defense contractors seek to develop fuel systems that meet the unique demands of military applications, thereby contributing to overall market growth.

Increased Demand for Commercial Aviation

The US Aircraft Engine Fuel Systems Market is poised for growth due to the increasing demand for commercial aviation. As air travel continues to rebound, airlines are expanding their fleets and upgrading existing aircraft with advanced fuel systems. The Federal Aviation Administration (FAA) projects a steady increase in passenger traffic, which is expected to reach 1 billion by 2026. This surge in demand necessitates the development of more efficient fuel systems to support the growing number of flights. Consequently, manufacturers are focusing on producing fuel systems that enhance performance and reliability, thereby driving market expansion.

Emergence of Smart Fuel Management Systems

The US Aircraft Engine Fuel Systems Market is witnessing the emergence of smart fuel management systems that leverage data analytics and IoT technologies. These systems provide real-time monitoring and predictive maintenance capabilities, allowing operators to optimize fuel usage and reduce costs. The integration of smart technologies is becoming increasingly important as airlines and operators seek to enhance operational efficiency. Market data indicates that the adoption of smart fuel management solutions could lead to a reduction in fuel consumption by up to 10%. This trend is likely to drive innovation and investment in the fuel systems market, positioning it for future growth.

Technological Innovations in Fuel Efficiency

The US Aircraft Engine Fuel Systems Market is experiencing a surge in technological innovations aimed at enhancing fuel efficiency. Advanced fuel management systems, including digital fuel flow meters and automated fuel control systems, are being integrated into aircraft engines. These innovations not only optimize fuel consumption but also reduce emissions, aligning with environmental regulations. According to recent data, fuel-efficient aircraft can save up to 15% in fuel costs, which is substantial given the rising fuel prices. The adoption of these technologies is likely to drive growth in the market as airlines seek to minimize operational costs while adhering to stringent environmental standards.

Government Regulations and Environmental Policies

The US Aircraft Engine Fuel Systems Market is significantly influenced by government regulations and environmental policies. The Environmental Protection Agency (EPA) has implemented stringent emissions standards that require aircraft manufacturers to adopt cleaner fuel technologies. These regulations are pushing the industry towards the development of advanced fuel systems that comply with environmental standards. The market is likely to see an increase in demand for systems that utilize sustainable aviation fuels (SAFs) and other eco-friendly alternatives. This regulatory landscape not only shapes product development but also creates opportunities for innovation within the market.