Increased Defense Spending

The Aircraft Design and Engineering Market is significantly impacted by increased defense spending across various nations. Governments are prioritizing the modernization of their military fleets, which necessitates advanced aircraft designs and engineering solutions. This trend is particularly evident in regions where geopolitical tensions are rising, prompting nations to invest heavily in their defense capabilities. According to recent defense budgets, spending on military aviation is projected to grow by approximately 5% annually over the next five years. This influx of funding is likely to stimulate innovation and competition within the Aircraft Design and Engineering Market, as companies strive to meet the evolving demands of defense contracts.

Sustainable Aviation Initiatives

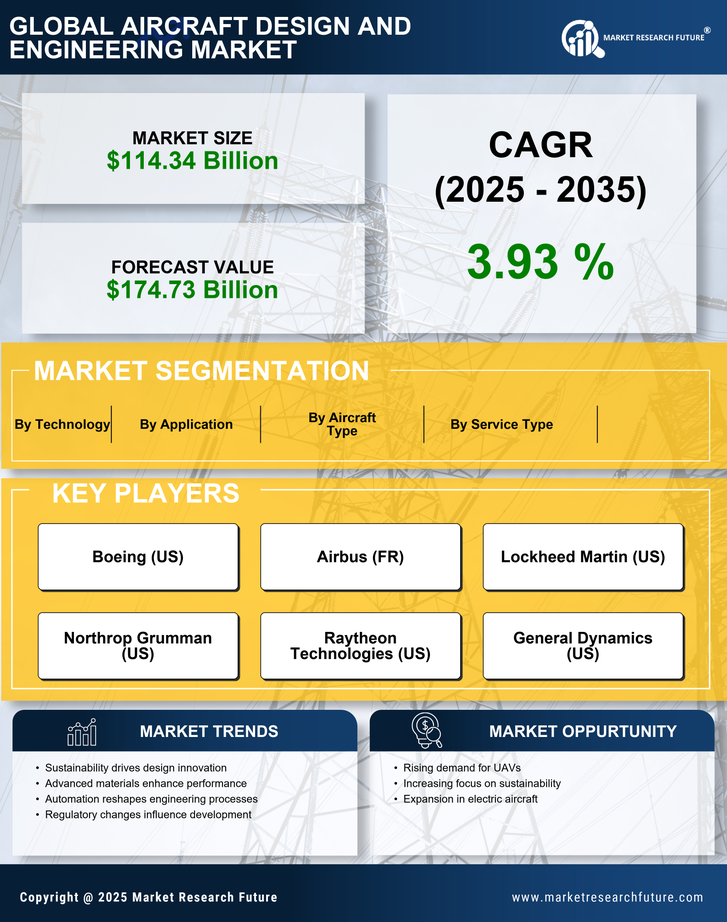

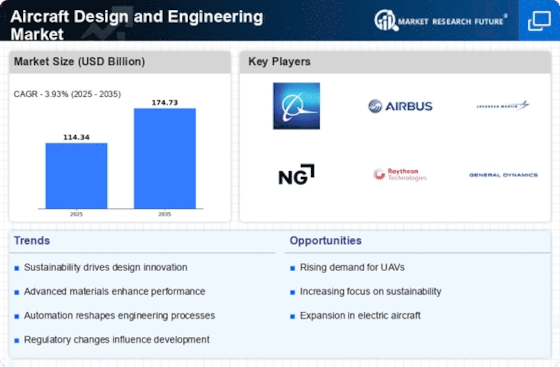

The Aircraft Design and Engineering Market is increasingly influenced by sustainable aviation initiatives aimed at reducing carbon emissions and enhancing fuel efficiency. Regulatory bodies and industry stakeholders are advocating for greener technologies, which has led to a surge in research and development investments. For instance, the International Air Transport Association has set ambitious targets for net-zero emissions by 2050, prompting manufacturers to innovate in aircraft design. This shift towards sustainability is not merely a trend; it is becoming a fundamental requirement for compliance and competitiveness. As a result, companies that prioritize eco-friendly designs are likely to gain a competitive edge, potentially capturing a larger market share in the Aircraft Design and Engineering Market.

Emergence of Hybrid Propulsion Systems

The Aircraft Design and Engineering Market is witnessing a notable shift towards hybrid propulsion systems, which combine traditional jet engines with electric propulsion technologies. This trend is driven by the need for improved fuel efficiency and reduced environmental impact. Hybrid systems are expected to play a crucial role in the future of aviation, with projections indicating that they could reduce fuel consumption by up to 30%. As manufacturers explore these innovative propulsion methods, the Aircraft Design and Engineering Market is likely to see a surge in demand for designs that accommodate hybrid technologies. This evolution not only aligns with sustainability goals but also opens new avenues for research and development.

Digital Transformation in Design Processes

The Aircraft Design and Engineering Market is undergoing a profound transformation due to the integration of digital technologies. Advanced software tools, such as computer-aided design (CAD) and simulation software, are revolutionizing the design process, enabling engineers to create more efficient and innovative aircraft designs. The adoption of digital twins and artificial intelligence is streamlining workflows, reducing time-to-market, and enhancing collaboration among teams. According to industry reports, the digital transformation in engineering could lead to a 30% reduction in design cycle times. This shift not only improves operational efficiency but also allows for more complex and optimized designs, positioning companies favorably within the Aircraft Design and Engineering Market.

Growing Demand for Unmanned Aerial Vehicles

The Aircraft Design and Engineering Market is experiencing a surge in demand for unmanned aerial vehicles (UAVs), driven by their diverse applications in sectors such as agriculture, surveillance, and logistics. As industries recognize the operational efficiencies and cost savings associated with UAVs, the market for these aircraft is expanding rapidly. Reports indicate that the UAV market could reach a valuation of over 100 billion dollars by 2030. This growing interest in UAV technology is prompting engineers to innovate and design specialized aircraft that meet specific operational requirements. Consequently, the Aircraft Design and Engineering Market is likely to evolve to accommodate this burgeoning segment, fostering new opportunities for growth and development.