Uk Skincare Size

UK Skincare Market Growth Projections and Opportunities

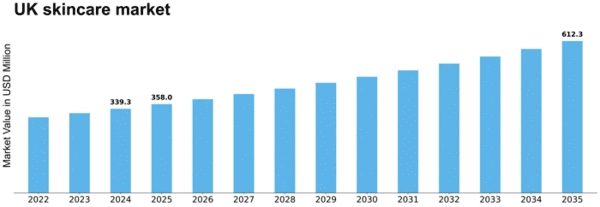

In 2022, the UK skincare market was estimated to be worth USD 4.5 billion. The industry for skincare is expected to increase at a compound annual growth rate (CAGR) of 3.00% between 2023 and 2032, from USD 4.6 billion in 2023 to USD 5.9 billion. One key factor driving the UK skincare sector is consumers' desire to utilize high-end skincare products. Customers in the country are opting to use skincare products including cleansers, serums, moisturizers, and other things as a result of a rise in skin problems.

The UK skincare market is influenced by a variety of factors that collectively define its dynamics. Consumer preferences and trends play a pivotal role, with individuals often seeking products aligned with their skincare goals, whether it be anti-aging, hydration, or specific skin concerns. Influenced by factors like social media, beauty influencers, and evolving beauty standards, consumer demand can shift rapidly, impacting the market as brands strive to meet the latest skincare trends.

Economic factors significantly contribute to the performance of the UK skincare market. Disposable income levels, consumer spending habits, and overall economic stability influence purchasing decisions. During periods of economic prosperity, consumers may be more inclined to invest in premium skincare products, while economic downturns can lead to a shift towards more budget-friendly options. The market is also responsive to currency fluctuations, affecting the pricing and availability of imported skincare brands and ingredients.

Regulatory factors, including compliance with safety standards and ingredient regulations, are crucial in the skincare industry. The UK skincare market is subject to stringent regulations ensuring the safety and efficacy of products. Changes in regulations, such as bans or restrictions on certain ingredients, can impact the formulation and marketing of skincare products. Adherence to ethical and sustainable practices is also gaining prominence, with consumers showing a growing preference for environmentally friendly and cruelty-free skincare options.

Technological advancements in skincare formulations and manufacturing processes contribute to product innovation and market competitiveness. The integration of advanced ingredients, such as peptides, antioxidants, and hyaluronic acid, reflects the dynamic nature of skincare research. Additionally, advancements in packaging technology and product delivery systems play a role in enhancing the overall consumer experience. Skincare brands that embrace and incorporate these technological advancements often gain a competitive edge in the market.

Distribution channels and retail landscapes are vital factors shaping the UK skincare market. The rise of e-commerce has transformed the way consumers access skincare products, providing convenience and a wide array of options. Traditional brick-and-mortar stores, specialty skincare boutiques, and department store counters continue to be significant channels as well. The accessibility of products through various channels influences consumer choices and brand visibility, with online reviews and recommendations playing a crucial role in decision-making.

Market competition among skincare brands is intense, driving innovation and marketing strategies. Established brands and emerging players constantly vie for consumer attention through product differentiation, marketing campaigns, and endorsements. Brand reputation, transparency in ingredient sourcing, and a commitment to addressing consumer needs contribute to long-term success in a competitive market. Consumer loyalty can be fickle, making it imperative for brands to stay attuned to market trends and maintain the quality and effectiveness of their products.

Cultural factors and societal attitudes towards beauty and self-care also influence the UK skincare market. With an increasing emphasis on wellness and self-care, skincare is viewed as an essential component of a holistic approach to health and beauty. Cultural diversity and inclusivity are gaining recognition, prompting skincare brands to offer products catering to a wide range of skin types and tones.

Leave a Comment