Growing Emphasis on Sustainability

Sustainability has become a central theme in the UK proptech market, as stakeholders increasingly prioritize environmentally friendly practices. The demand for energy-efficient buildings and sustainable development solutions is on the rise, with 70% of property developers now incorporating green technologies into their projects. This shift is not only driven by consumer preferences but also by regulatory pressures aimed at reducing carbon emissions. Proptech companies that offer innovative solutions for energy management, waste reduction, and sustainable construction are likely to thrive in this evolving landscape. The integration of sustainability into the proptech market is expected to reshape investment strategies and consumer choices, ultimately leading to a more responsible and resilient real estate sector.

Regulatory Changes Promoting Innovation

The UK government is actively implementing regulatory changes aimed at fostering innovation within the proptech market. Recent initiatives focus on simplifying the planning process and encouraging the adoption of digital technologies in real estate transactions. For instance, the introduction of digital land registration has streamlined property transfers, reducing the time and costs associated with traditional methods. These regulatory advancements are expected to enhance transparency and efficiency in the market, making it more attractive for both investors and consumers. As the proptech market adapts to these changes, companies that align their offerings with regulatory requirements may find new opportunities for growth and expansion.

Increased Investment in Proptech Startups

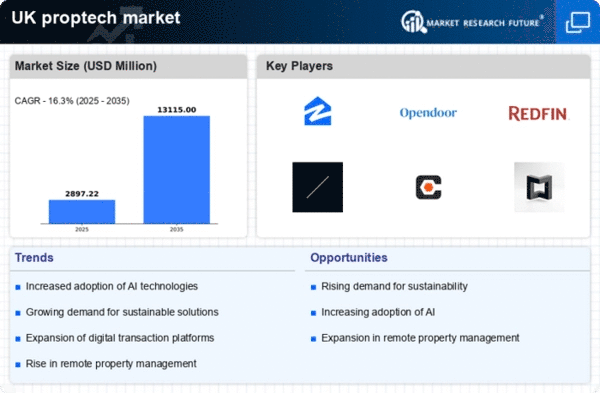

Investment in proptech startups within the UK has surged, reflecting a growing confidence in the potential of technology to transform the real estate sector. In 2025, venture capital funding for proptech companies reached £1.2 billion, indicating a 25% increase from the previous year. This influx of capital is enabling startups to develop innovative solutions that address various challenges in the property market, such as affordability, accessibility, and sustainability. Investors are particularly interested in technologies that enhance user experience and streamline processes, which could lead to significant advancements in the proptech market. As more investors recognize the value of proptech, the industry is likely to see continued growth and diversification, fostering a competitive landscape that benefits consumers and businesses alike.

Rising Demand for Remote Property Management

The proptech market in the UK is experiencing a notable increase in demand for remote property management solutions. This trend is driven by the need for landlords and property managers to efficiently oversee their assets without being physically present. As of November 2025, approximately 60% of property managers are utilizing digital tools to streamline operations, enhance tenant communication, and manage maintenance requests. This shift not only improves operational efficiency but also reduces costs associated with traditional management methods. The proptech market is thus evolving to accommodate these needs, with innovative platforms emerging to facilitate remote interactions and transactions. The growing reliance on technology in property management is likely to continue, suggesting a robust future for companies that can provide effective remote solutions.

Technological Advancements Enhancing User Experience

Technological advancements are significantly enhancing user experience within the proptech market in the UK. Innovations such as virtual reality (VR) and augmented reality (AR) are transforming property viewings, allowing potential buyers and tenants to explore spaces remotely. As of November 2025, around 40% of real estate agencies are utilizing VR and AR technologies to provide immersive experiences, which can lead to quicker decision-making and increased sales. Furthermore, the integration of artificial intelligence (AI) in property search platforms is improving the accuracy of property recommendations, catering to individual preferences. These technological enhancements are likely to redefine how consumers interact with the real estate market, making it more efficient and user-friendly.