Urbanization and Housing Demand

Urbanization trends in Germany are significantly impacting the proptech market. As more individuals migrate to urban areas, the demand for housing continues to rise. This urban influx is projected to increase housing demand by 20% over the next five years. Consequently, proptech companies are leveraging technology to address these challenges, offering innovative solutions such as virtual property tours and online leasing platforms. These advancements not only streamline the rental process but also cater to the preferences of a younger, tech-oriented demographic. The interplay between urbanization and technology adoption is likely to shape the future landscape of the proptech market.

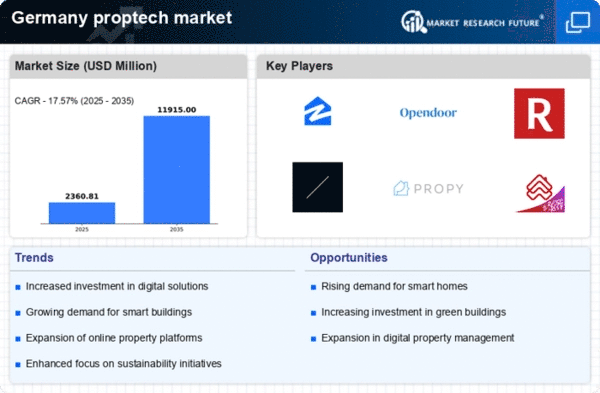

Technological Advancements in Real Estate

The proptech market in Germany is experiencing a surge due to rapid technological advancements. Innovations such as artificial intelligence, big data analytics, and blockchain are transforming traditional real estate practices. For instance, AI-driven tools are enhancing property management efficiency, while blockchain is facilitating secure transactions. In 2025, the market is projected to grow by approximately 15%, driven by these technologies. The integration of smart home devices is also becoming prevalent, appealing to tech-savvy consumers. This trend indicates a shift towards a more data-driven approach in the proptech market, where technology plays a pivotal role in decision-making and operational efficiency.

Regulatory Support for Digital Transformation

Germany's regulatory environment is increasingly supportive of digital transformation within the proptech market. The government has introduced various initiatives aimed at fostering innovation and encouraging the adoption of digital solutions in real estate. For example, the Digital Strategy 2025 outlines plans to enhance digital infrastructure, which is crucial for proptech companies. This supportive framework is likely to attract investments, with an estimated €1 billion expected to flow into the sector by 2026. As regulations evolve, they may facilitate smoother operations for proptech firms, thereby enhancing their competitiveness in the market.

Shift Towards Remote Work and Digital Services

The shift towards remote work is influencing the proptech market in Germany. As companies adopt flexible work arrangements, there is a growing need for digital services that cater to remote employees. This includes virtual office solutions and co-working spaces that can be easily accessed through proptech platforms. The market for such services is expected to expand by 25% in the coming years, reflecting the changing dynamics of work and real estate. Proptech companies are capitalizing on this trend by offering innovative solutions that enhance the remote working experience, thereby positioning themselves favorably within the evolving market landscape.

Investment in Sustainable Real Estate Solutions

The growing emphasis on sustainability is reshaping the proptech market in Germany. Investors are increasingly prioritizing eco-friendly properties, leading to a rise in demand for sustainable real estate solutions. In 2025, it is estimated that investments in green buildings will account for over 30% of total real estate investments. Proptech companies are responding by developing platforms that facilitate the assessment and certification of sustainable properties. This trend not only aligns with environmental goals but also appeals to a market segment that values sustainability, thereby driving growth in the proptech market.