Changing Consumer Preferences

Consumer preferences are evolving, significantly impacting the proptech market. Today's buyers and renters are increasingly seeking convenience, transparency, and personalized experiences in their real estate transactions. This shift is prompting proptech companies to develop user-friendly platforms that facilitate seamless interactions between buyers, sellers, and agents. Moreover, the demand for digital solutions that streamline processes, such as virtual tours and online transactions, is on the rise. As a result, the proptech market is likely to see a substantial increase in user engagement, with an estimated 60% of consumers preferring digital platforms for their real estate needs.

Regulatory Changes and Compliance

The proptech market is influenced by ongoing regulatory changes that aim to enhance transparency and protect consumer rights. New regulations are being introduced to address issues such as data privacy, cybersecurity, and fair housing practices. These regulations compel proptech companies to adapt their business models and ensure compliance, which can lead to increased operational costs. However, this also presents an opportunity for innovation, as companies that proactively embrace compliance can differentiate themselves in a competitive market. The impact of these regulatory changes is expected to shape the proptech market, potentially leading to a more robust and trustworthy industry.

Integration of Blockchain Technology

The integration of blockchain technology is emerging as a transformative driver in the proptech market. Blockchain offers enhanced security, transparency, and efficiency in real estate transactions, which can significantly reduce fraud and streamline processes. Smart contracts, powered by blockchain, enable automated and secure agreements between parties, minimizing the need for intermediaries. As awareness of blockchain's benefits grows, more proptech companies are exploring its applications, potentially revolutionizing property transactions. The adoption of blockchain technology in the proptech market could lead to a more efficient and trustworthy ecosystem, attracting further investment and consumer interest.

Investment in Real Estate Technology

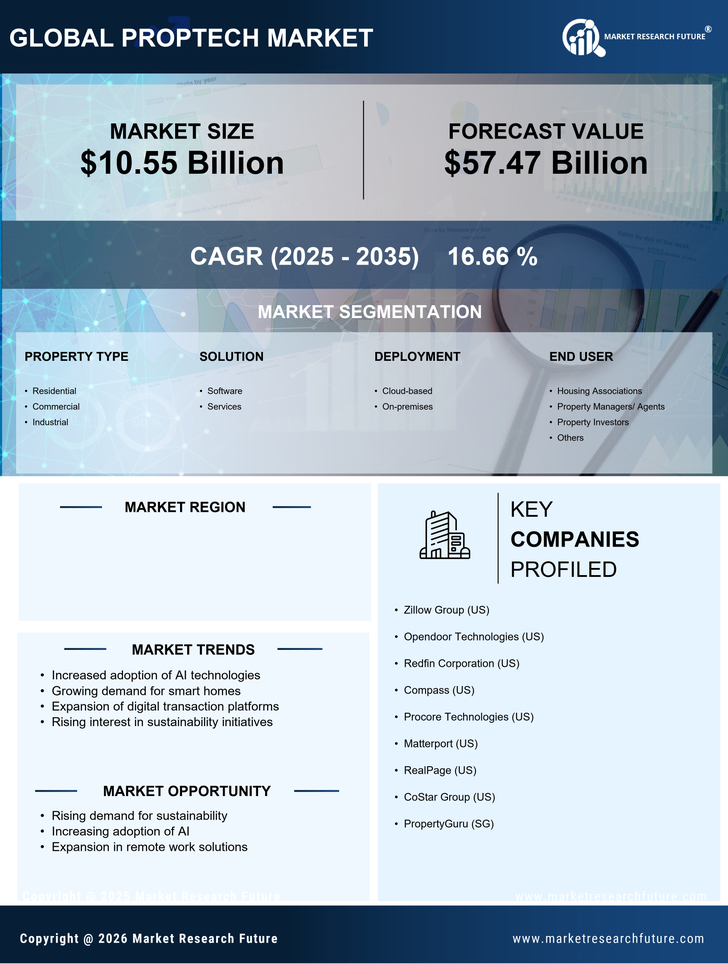

Investment in real estate technology is a driving force behind the growth of the proptech market. Venture capital funding for proptech startups has surged, with investments reaching over $10 billion in recent years. This influx of capital is enabling companies to develop cutting-edge solutions that address various challenges within the real estate sector. Investors are increasingly recognizing the potential for high returns in the proptech market, particularly as traditional real estate practices become more digitized. This trend is likely to continue, fostering innovation and competition among proptech firms.

Technological Advancements in Real Estate

The proptech market is experiencing a surge in technological advancements that are reshaping the real estate landscape. Innovations such as artificial intelligence, machine learning, and big data analytics are being integrated into property management and investment strategies. These technologies enhance decision-making processes, improve operational efficiency, and provide valuable insights into market trends. For instance, the use of AI-driven platforms can analyze vast amounts of data to predict property values and investment opportunities. As a result, the proptech market is projected to grow at a CAGR of approximately 15% over the next five years, driven by these technological innovations.