Regulatory Framework Enhancements

The evolving regulatory landscape in the UK is a crucial driver for the pegylated drugs market. Recent initiatives by regulatory bodies aim to streamline the approval process for innovative therapies, including pegylated formulations. These enhancements are designed to facilitate faster access to new treatments for patients, particularly those with unmet medical needs. In 2025, the UK government allocated £200 million to support regulatory science, which is expected to expedite the development and approval of pegylated drugs. This supportive environment may encourage pharmaceutical companies to invest in research and development, thereby expanding the pegylated drugs market. As regulations become more favorable, the potential for new pegylated therapies to enter the market increases, ultimately benefiting patients.

Growing Focus on Personalized Medicine

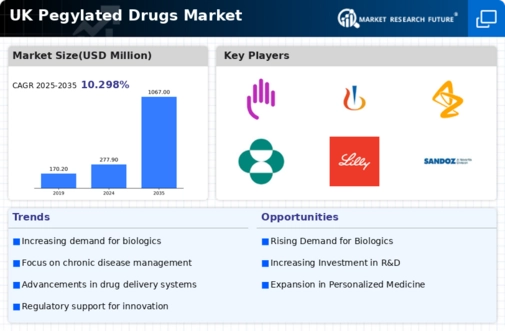

The shift towards personalized medicine is a significant driver for the pegylated drugs market. Tailoring treatments to individual patient profiles enhances therapeutic outcomes and minimizes adverse effects. Pegylated drugs, with their ability to be modified for specific patient needs, align well with this trend. The UK healthcare system is increasingly adopting personalized approaches, with an estimated 30% of new drug approvals in 2025 focusing on personalized therapies. This growing emphasis on individualized treatment plans suggests that the pegylated drugs market will benefit from increased demand for customized therapies. As healthcare providers seek to optimize treatment efficacy, the integration of pegylated drugs into personalized medicine frameworks is likely to expand, fostering market growth.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in the UK is a pivotal driver for the pegylated drugs market. Conditions such as cancer, diabetes, and autoimmune disorders necessitate innovative treatment options. Pegylated drugs, known for their extended half-life and reduced immunogenicity, are increasingly being adopted in therapeutic regimens. According to recent data, the prevalence of diabetes alone is projected to reach 5 million cases by 2025, highlighting the urgent need for effective therapies. This trend suggests that healthcare providers are likely to turn to pegylated formulations to enhance patient outcomes, thereby propelling market growth. As the healthcare system adapts to these challenges, the pegylated drugs market is expected to expand significantly, driven by the demand for more effective and patient-friendly treatment options.

Rising Investment in Biopharmaceutical Research

The surge in investment in biopharmaceutical research is a notable driver for the pegylated drugs market. The UK has witnessed a substantial increase in funding for biopharmaceutical innovations, with investments reaching £1 billion in 2025. This financial support is directed towards the development of novel pegylated drugs, which are often at the forefront of biopharmaceutical advancements. The pegylated drugs market stands to gain from this influx of capital, as it enables companies to explore new therapeutic applications and improve existing formulations. As research progresses, the potential for groundbreaking pegylated therapies to emerge increases, suggesting a robust growth trajectory for the market.

Technological Advancements in Drug Delivery Systems

Technological innovations in drug delivery systems are transforming the pegylated drugs market. Enhanced delivery mechanisms, such as nanoparticles and liposomes, are being integrated with pegylated drugs to improve bioavailability and therapeutic efficacy. These advancements allow for more precise targeting of diseased tissues, which is particularly beneficial in oncology and chronic disease management. The UK market has seen a surge in research funding, with investments exceeding £500 million in 2024 alone, aimed at developing these advanced delivery systems. This influx of capital is likely to foster collaborations between pharmaceutical companies and research institutions, further driving the pegylated drugs market. As these technologies mature, they may lead to the introduction of novel pegylated therapies that could revolutionize treatment paradigms.