Rising Investment in Biotechnology

The surge investment within the biotechnology sector is propelling the Pegylated Drugs Market forward. Venture capital and private equity funding are increasingly directed towards companies developing pegylated therapies, recognizing their potential to address unmet medical needs. This influx of capital enables research and development efforts to accelerate, leading to the introduction of novel pegylated drugs. The biotechnology sector is projected to grow at a CAGR of 10% through 2027, with pegylated drugs playing a pivotal role in this expansion. The financial backing not only supports innovation but also enhances competition within the market, ultimately benefiting patients through improved treatment options.

Advancements in Drug Delivery Systems

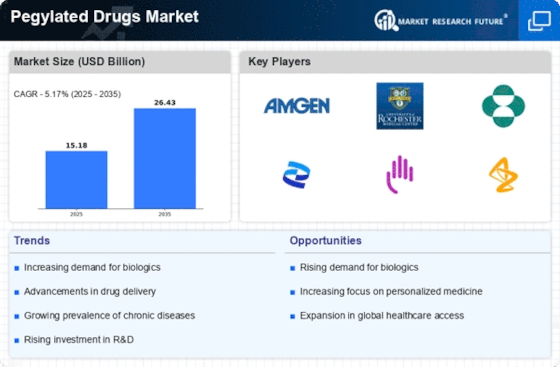

Innovations in drug delivery systems are significantly influencing the Pegylated Drugs Market. The incorporation of pegylation technology enhances the pharmacokinetics of drugs, allowing for more efficient delivery and improved therapeutic efficacy. This advancement is particularly relevant in oncology, where pegylated formulations can target tumors more effectively while minimizing side effects. The market is witnessing a shift towards personalized medicine, where pegylated drugs are tailored to individual patient profiles, further driving demand. As a result, the pegylated drugs segment is expected to grow at a compound annual growth rate (CAGR) of 8% over the next five years, indicating a robust market trajectory fueled by these technological advancements.

Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and autoimmune disorders is a primary driver for the Pegylated Drugs Market. As these conditions become more prevalent, the demand for effective treatment options increases. Pegylated drugs, known for their extended half-life and reduced immunogenicity, are increasingly utilized in therapeutic regimens. For instance, pegylated interferon is widely used in the treatment of hepatitis C, contributing to a substantial market share. The market for pegylated drugs is projected to reach USD 30 billion by 2026, reflecting the urgent need for innovative therapies that can improve patient outcomes. This trend underscores the importance of pegylated formulations in addressing the healthcare challenges posed by chronic diseases.

Regulatory Support for Biopharmaceuticals

Regulatory bodies are increasingly supportive of biopharmaceutical innovations, which is a crucial factor for the Pegylated Drugs Market. Streamlined approval processes and incentives for the development of pegylated drugs encourage pharmaceutical companies to invest in this area. For example, the FDA has established guidelines that facilitate the approval of pegylated formulations, recognizing their potential to improve therapeutic outcomes. This regulatory environment not only fosters innovation but also enhances market access for new pegylated drugs. As a result, the market is expected to expand, with an estimated increase in the number of approved pegylated drugs by 20% over the next few years, reflecting the positive impact of regulatory support.

Increasing Awareness and Acceptance of Biologics

There is a growing awareness and acceptance of biologics among healthcare professionals and patients, which is positively impacting the Pegylated Drugs Market. As more stakeholders recognize the benefits of biologic therapies, including pegylated drugs, the demand for these treatments is likely to rise. Educational initiatives and marketing efforts by pharmaceutical companies are contributing to this trend, highlighting the efficacy and safety profiles of pegylated formulations. The market for biologics is expected to reach USD 400 billion by 2025, with pegylated drugs constituting a significant portion of this growth. This increasing acceptance is crucial for the sustained expansion of the pegylated drugs market.