Government Initiatives and Funding

Government initiatives play a crucial role in shaping the Spain OEM patient monitoring and vital sign OEM module market. The Spanish government has been actively promoting digital health solutions through various funding programs and incentives aimed at enhancing healthcare delivery. For instance, the Ministry of Health has allocated significant resources to support the adoption of telemedicine and remote monitoring technologies. This financial backing encourages healthcare facilities to invest in OEM patient monitoring systems, thereby expanding the market. Furthermore, the implementation of national health strategies that prioritize digital transformation in healthcare is likely to create a favorable environment for OEMs. As a result, the Spain OEM patient monitoring and vital sign OEM module market is expected to benefit from increased investments and a supportive regulatory framework, fostering innovation and growth.

Focus on Chronic Disease Management

Chronic disease management is becoming a focal point in the Spain OEM patient monitoring and vital sign OEM module market. With a significant portion of the population suffering from chronic conditions such as diabetes and cardiovascular diseases, there is an increasing need for effective monitoring solutions. The Spanish healthcare system is shifting towards proactive management of these diseases, which necessitates the use of advanced monitoring technologies. OEMs are responding by developing specialized modules that cater to the unique needs of chronic disease patients, enabling healthcare providers to deliver personalized care. This focus on chronic disease management is likely to drive market growth, as healthcare providers seek to improve patient outcomes and reduce hospital readmissions. Consequently, the Spain OEM patient monitoring and vital sign OEM module market is poised for expansion as it aligns with the evolving healthcare landscape.

Emphasis on Data Security and Privacy

Data security and privacy concerns are increasingly influencing the Spain OEM patient monitoring and vital sign OEM module market. As healthcare providers adopt more connected devices for patient monitoring, the need to protect sensitive patient information becomes paramount. Regulatory frameworks, such as the General Data Protection Regulation (GDPR), impose strict guidelines on data handling and storage, compelling OEMs to prioritize security features in their products. This emphasis on data protection not only ensures compliance but also builds trust among patients and healthcare providers. As a result, OEMs are investing in advanced encryption technologies and secure data transmission methods to safeguard patient information. This focus on data security is likely to enhance the credibility of the Spain OEM patient monitoring and vital sign OEM module market, fostering greater adoption of innovative monitoring solutions.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into patient monitoring systems is emerging as a transformative driver within the Spain OEM patient monitoring and vital sign OEM module market. AI technologies enable more accurate data analysis and predictive analytics, which can significantly enhance patient care. For example, AI algorithms can identify patterns in vital signs that may indicate potential health issues, allowing for timely interventions. The Spanish healthcare sector is increasingly recognizing the potential of AI, with several hospitals and clinics already implementing AI-driven monitoring solutions. This trend is expected to accelerate, as OEMs develop more sophisticated modules that incorporate AI capabilities. The growing acceptance of AI in healthcare not only improves patient outcomes but also streamlines operational efficiencies, thereby contributing to the overall growth of the Spain OEM patient monitoring and vital sign OEM module market.

Rising Demand for Remote Patient Monitoring

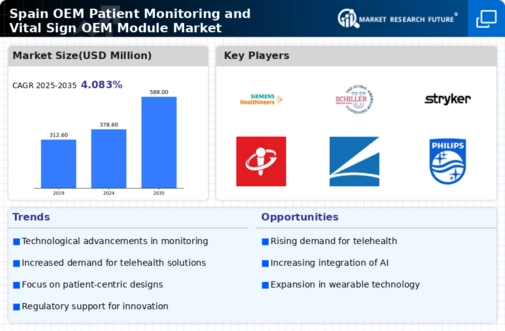

The Spain OEM patient monitoring and vital sign OEM module market is experiencing a notable increase in demand for remote patient monitoring solutions. This trend is driven by the growing emphasis on patient-centric care and the need for continuous health monitoring. According to recent data, the market for remote monitoring devices in Spain is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is largely attributed to the aging population and the rising prevalence of chronic diseases, which necessitate regular monitoring. As healthcare providers seek to enhance patient outcomes while reducing costs, the integration of advanced monitoring technologies becomes essential. Consequently, OEMs are focusing on developing innovative solutions that cater to these needs, thereby propelling the growth of the Spain OEM patient monitoring and vital sign OEM module market.