Expansion of Telehealth Services

The expansion of telehealth services across South America is significantly impacting the Oem Patient Monitoring Vital Sign Oem Module Market. As healthcare systems adapt to the growing demand for remote consultations, the need for reliable monitoring solutions becomes paramount. Telehealth platforms require seamless integration with patient monitoring systems to ensure accurate data transmission and effective patient management. Recent statistics indicate that telehealth usage in South America has surged by over 50% in the past year, highlighting the urgency for compatible OEM modules. This trend is likely to drive market growth, as healthcare providers seek to enhance their telehealth offerings with advanced monitoring technologies.

Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure in South America are significantly influencing the Oem Patient Monitoring Vital Sign Oem Module Market. Various countries in the region are allocating funds to improve healthcare services, particularly in rural and underserved areas. For instance, Brazil's Ministry of Health has launched programs to integrate advanced monitoring technologies into public health systems. Such initiatives are expected to increase the adoption of OEM modules, as they provide essential tools for healthcare professionals to monitor patients effectively. The financial support from governments is likely to stimulate market growth, fostering innovation and accessibility in patient monitoring solutions.

Increasing Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in South America, which is driving the demand for the Oem Patient Monitoring Vital Sign Oem Module Market. Healthcare stakeholders are recognizing the importance of early detection and management of health issues to reduce long-term healthcare costs. This shift towards preventive measures is prompting healthcare providers to invest in monitoring solutions that facilitate regular health assessments. As a result, OEM modules that offer comprehensive monitoring capabilities are becoming increasingly popular. The trend towards preventive healthcare is expected to create new opportunities for market players, as they develop innovative solutions tailored to meet the needs of proactive health management.

Rising Demand for Remote Patient Monitoring

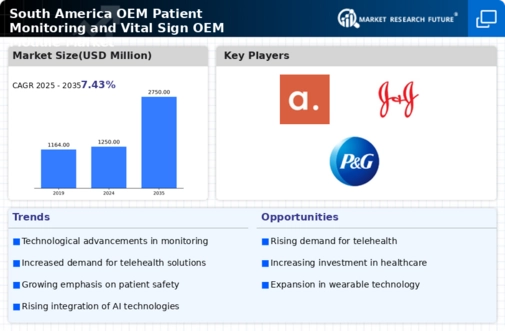

The South America Oem Patient Monitoring Vital Sign Oem Module Market is experiencing a notable increase in demand for remote patient monitoring solutions. This trend is driven by the growing prevalence of chronic diseases, which necessitate continuous monitoring of patients' vital signs. According to recent data, approximately 30% of the population in South America suffers from chronic conditions, leading to a heightened need for effective monitoring systems. Healthcare providers are increasingly adopting OEM modules that facilitate remote monitoring, allowing for timely interventions and improved patient outcomes. This shift not only enhances patient care but also reduces the burden on healthcare facilities, indicating a robust growth trajectory for the market.

Integration of Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and data analytics into patient monitoring systems is emerging as a key driver in the South America Oem Patient Monitoring Vital Sign Oem Module Market. AI technologies enable more accurate predictions and personalized care plans based on real-time data analysis. As healthcare providers seek to enhance patient outcomes, the demand for OEM modules that incorporate these advanced technologies is expected to rise. Reports suggest that the market for AI in healthcare in South America could reach USD 1 billion by 2027, indicating a strong potential for growth in the patient monitoring segment. This technological evolution is likely to reshape the landscape of patient monitoring, making it more efficient and effective.