Regulatory Adaptations and Support

The UK microarray market benefits from a supportive regulatory framework that encourages innovation while ensuring safety and efficacy. The Medicines and Healthcare products Regulatory Agency (MHRA) has established guidelines that facilitate the approval process for new microarray technologies. This regulatory environment is crucial for fostering trust among healthcare providers and patients. Furthermore, the UK government has launched initiatives aimed at streamlining the regulatory pathways for genomic technologies, which is likely to accelerate market entry for novel microarray products. As a result, the UK microarray market is expected to expand, driven by both regulatory support and the increasing demand for advanced diagnostic tools.

Growing Investment in Genomic Research

The UK microarray market is witnessing a surge in investment directed towards genomic research. Public and private funding initiatives are increasingly supporting projects that utilize microarray technologies for various applications, including cancer research and rare disease studies. The UK government has committed substantial resources to the Genomics England initiative, which aims to sequence the genomes of 100,000 patients. This investment not only enhances the capabilities of the UK microarray market but also fosters collaboration between academic institutions and industry players. As funding continues to flow into genomic research, the demand for microarray technologies is likely to increase, further propelling market growth.

Increased Focus on Personalized Medicine

The UK microarray market is significantly influenced by the growing emphasis on personalized medicine. As healthcare shifts towards tailored treatments based on individual genetic profiles, microarrays play a pivotal role in identifying genetic variations that inform therapeutic decisions. The National Health Service (NHS) has initiated programs to integrate genomic data into clinical practice, which is expected to enhance patient outcomes. This trend is reflected in the rising demand for microarray technologies, with the market projected to reach a valuation of over GBP 300 million by 2028. The alignment of microarray applications with personalized medicine initiatives underscores the potential for growth within the UK microarray market.

Rising Demand for Diagnostic Applications

The UK microarray market is experiencing a notable increase in demand for diagnostic applications. Microarrays are increasingly utilized in clinical laboratories for the detection of genetic disorders, infectious diseases, and cancer biomarkers. The growing prevalence of chronic diseases in the UK has heightened the need for efficient diagnostic tools, positioning microarrays as a vital component of modern healthcare. According to recent estimates, the diagnostic segment of the microarray market is expected to account for over 60% of the total market share by 2026. This trend indicates a robust growth trajectory for the UK microarray market, driven by the need for accurate and timely diagnostics in an evolving healthcare landscape.

Technological Advancements in Microarray Technology

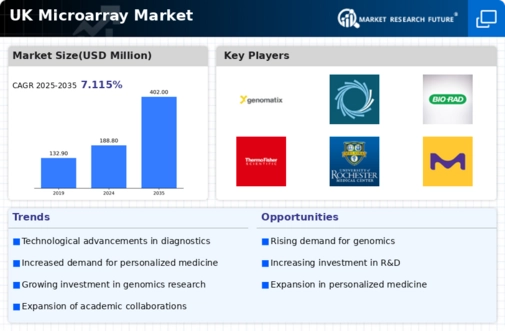

The UK microarray market is experiencing rapid technological advancements that enhance the capabilities of microarray platforms. Innovations such as high-density arrays and next-generation sequencing integration are driving growth. These advancements allow for more precise and comprehensive genomic analyses, which are crucial for research and clinical applications. The UK government has invested in biotechnology research, fostering an environment conducive to innovation. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of the increasing adoption of microarray technologies in various sectors, including pharmaceuticals and diagnostics, thereby solidifying the UK's position as a leader in the microarray market.