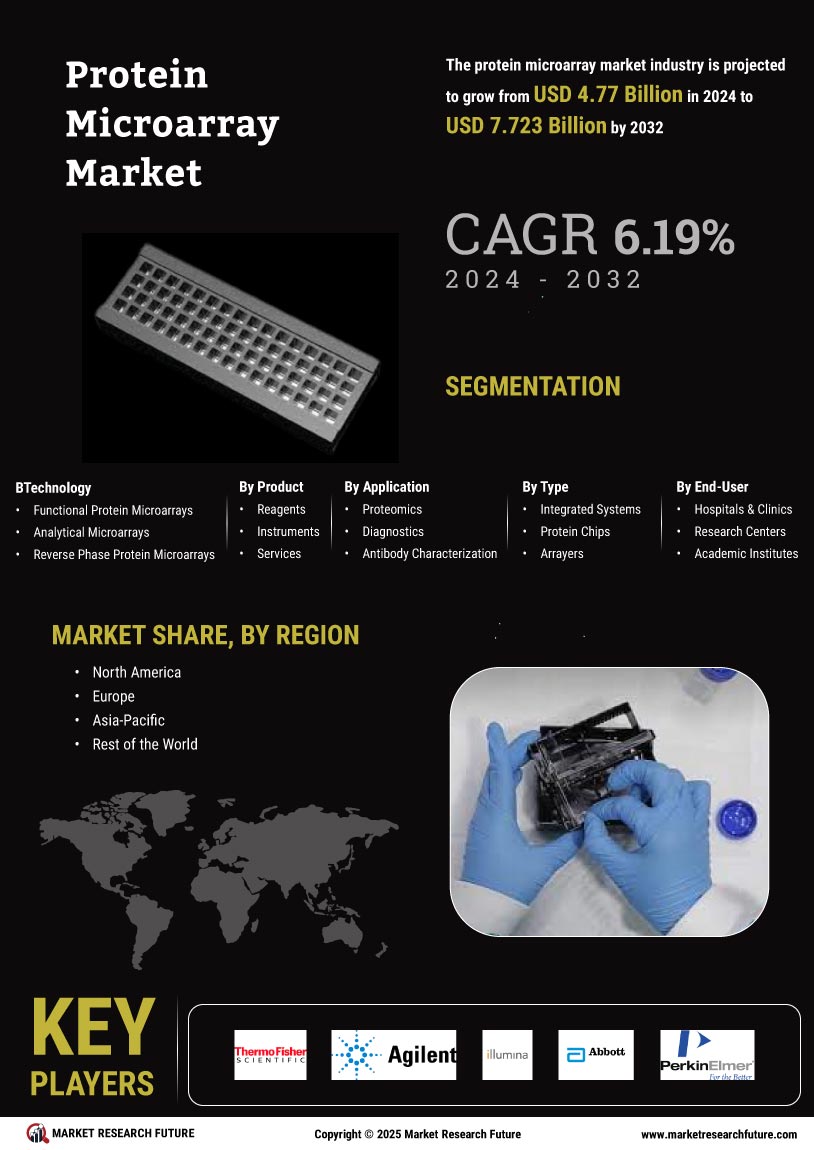

Rising Demand for Biomarkers

The increasing focus on biomarker discovery is driving The Global Protein Microarray Industry. Biomarkers play a crucial role in disease diagnosis, prognosis, and treatment monitoring. As healthcare systems evolve, the need for precise and reliable biomarkers is becoming more pronounced. According to recent estimates, the biomarker market is projected to reach USD 60 billion by 2026, indicating a robust growth trajectory. This surge in demand for biomarkers is likely to propel the adoption of protein microarrays, which facilitate high-throughput analysis of protein interactions and functions. Consequently, The Global Protein Microarray Industry is expected to witness significant growth as researchers and clinicians seek innovative solutions for biomarker identification and validation.

Emergence of Personalized Medicine

The shift towards personalized medicine is significantly impacting The Global Protein Microarray Industry. Personalized medicine aims to tailor medical treatment to individual characteristics, needs, and preferences, which necessitates advanced diagnostic tools for accurate patient stratification. Protein microarrays are instrumental in identifying patient-specific biomarkers that can guide treatment decisions. The market for personalized medicine is projected to reach USD 2 trillion by 2030, indicating a substantial growth opportunity for protein microarray technologies. As healthcare providers increasingly embrace personalized approaches, the demand for protein microarrays is expected to rise, further driving the growth of The Global Protein Microarray Industry.

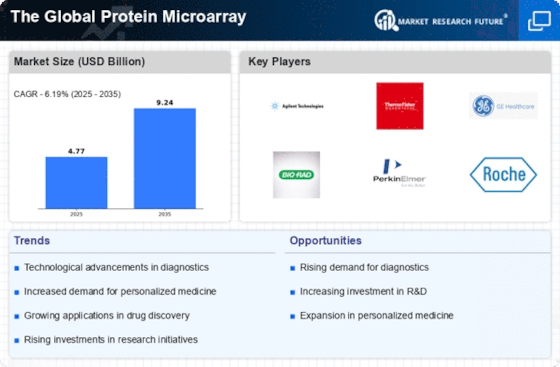

Advancements in Microarray Technology

Technological innovations are reshaping the landscape of The Global Protein Microarray Industry. Recent advancements in microarray technology, such as improved sensitivity, specificity, and multiplexing capabilities, are enhancing the utility of protein microarrays in various applications. For instance, the introduction of next-generation sequencing and novel detection methods has expanded the scope of protein microarrays in proteomics research. The market for protein microarrays is anticipated to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these technological enhancements. As researchers increasingly adopt these advanced tools, The Global Protein Microarray Industry is poised for substantial expansion.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases is propelling the demand for advanced diagnostic tools, thereby influencing The Global Protein Microarray Industry. Chronic diseases such as cancer, diabetes, and cardiovascular disorders require precise diagnostic methods for effective management. Protein microarrays offer a powerful platform for the identification of disease-specific biomarkers, which can facilitate early diagnosis and personalized treatment strategies. The World Health Organization (WHO) reports that chronic diseases account for approximately 71% of all deaths globally, underscoring the urgent need for innovative diagnostic solutions. This growing prevalence is likely to drive the adoption of protein microarrays, contributing to the expansion of The Global Protein Microarray Industry.

Growing Investment in Research and Development

The surge in investment in research and development activities is a key driver of The Global Protein Microarray Industry. Governments and private entities are allocating substantial funds to support innovative research in proteomics and genomics. This financial backing is fostering the development of novel protein microarray technologies and applications. For example, the National Institutes of Health (NIH) has significantly increased its funding for proteomics research, which is expected to stimulate advancements in protein microarray methodologies. As a result, The Global Protein Microarray Industry is likely to benefit from enhanced research capabilities and the introduction of cutting-edge products that cater to the evolving needs of the scientific community.