Rising Demand for Real-Time Data

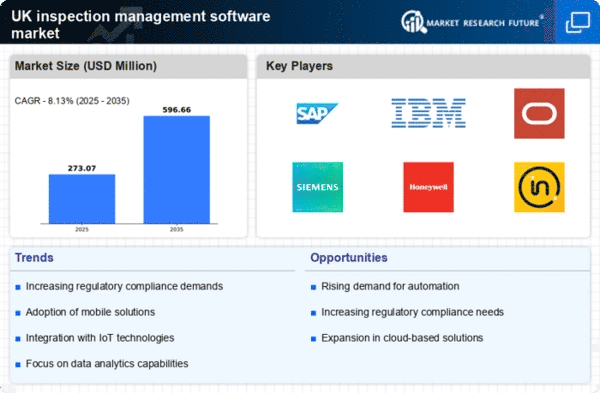

The inspection management-software market is experiencing a notable surge in demand for real-time data analytics. This trend is driven by the need for businesses to make informed decisions quickly. Companies are increasingly adopting software solutions that provide instant access to inspection results, enabling them to address issues proactively. In the UK, the market for inspection management software is projected to grow at a CAGR of approximately 12% over the next five years. This growth is indicative of a broader shift towards data-driven decision-making, where timely insights can significantly enhance operational efficiency and compliance. As industries such as construction and manufacturing continue to expand, the reliance on real-time data will likely become a cornerstone of effective inspection management.

Integration with IoT Technologies

The integration of Internet of Things (IoT) technologies into the inspection management-software market is transforming how inspections are conducted. IoT devices facilitate the collection of data from various sources, allowing for more comprehensive and accurate inspections. In the UK, the adoption of IoT-enabled inspection solutions is expected to increase, as businesses seek to enhance their operational capabilities. This integration not only streamlines the inspection process but also improves the accuracy of data collected, thereby reducing the likelihood of errors. The potential for IoT to provide continuous monitoring and alerts further enhances the value of inspection management software, making it an essential tool for industries that require stringent compliance and oversight.

Growing Emphasis on Risk Management

The inspection management-software market is increasingly influenced by a growing emphasis on risk management across various sectors. Companies are recognizing the importance of identifying and mitigating risks associated with inspections, particularly in industries such as construction and manufacturing. The UK market is witnessing a shift towards software solutions that incorporate risk assessment features, enabling organizations to proactively address potential issues before they escalate. This trend is likely to drive the demand for inspection management software, as businesses seek to enhance their risk management strategies. By integrating risk management capabilities, these software solutions can provide a more holistic approach to inspections, ensuring compliance and safety while minimizing operational disruptions.

Enhanced User Experience and Accessibility

The inspection management-software market is seeing a significant focus on enhancing user experience and accessibility. As organizations strive to improve efficiency, software developers are prioritizing intuitive interfaces and mobile accessibility. This trend is particularly relevant in the UK, where a diverse workforce requires tools that are easy to use and accessible from various devices. By improving user experience, companies can ensure higher adoption rates of inspection management software, leading to better compliance and operational outcomes. The emphasis on user-friendly design is likely to drive innovation within the market, as developers seek to create solutions that cater to the needs of a broad range of users, from field inspectors to management personnel.

Increased Investment in Digital Transformation

The inspection management-software market is benefiting from increased investment in digital transformation initiatives across various industries. Companies in the UK are recognizing the need to modernize their inspection processes to remain competitive. This shift towards digital solutions is likely to drive the adoption of inspection management software, as organizations seek to streamline operations and improve efficiency. The market is projected to see substantial growth, with investments in software solutions expected to rise significantly over the next few years. This trend reflects a broader commitment to leveraging technology to enhance operational capabilities, reduce costs, and ensure compliance with industry standards.