Regulatory Compliance Pressures

Regulatory compliance remains a pressing concern for many industries in France, significantly influencing the inspection management-software market. As regulations become more stringent, organizations are compelled to adopt software solutions that facilitate compliance tracking and reporting. The market is anticipated to grow by 10% as businesses seek to mitigate risks associated with non-compliance, which can lead to substantial financial penalties and reputational damage. Inspection management software provides the necessary tools to ensure adherence to industry standards and regulations, thereby safeguarding organizations against potential legal repercussions. This growing pressure for compliance is likely to drive further investment in inspection management solutions.

Increased Focus on Sustainability

Sustainability has emerged as a critical driver for the inspection management-software market in France. Companies are increasingly recognizing the importance of sustainable practices in their operations, leading to a demand for software that can help monitor and manage environmental compliance. The market is projected to grow by 12% as organizations seek to reduce their carbon footprint and adhere to environmental regulations. Inspection management software enables businesses to track their sustainability metrics, conduct audits, and ensure compliance with eco-friendly standards. This focus on sustainability not only enhances corporate responsibility but also appeals to environmentally conscious consumers, thereby influencing purchasing decisions and market dynamics.

Rising Demand for Quality Assurance

The inspection management-software market in France is experiencing a notable surge in demand for quality assurance across various industries. This trend is driven by the increasing emphasis on product quality and safety, particularly in sectors such as manufacturing, food and beverage, and pharmaceuticals. Companies are investing in inspection management software to streamline their quality control processes, ensuring compliance with stringent regulations. In 2025, the market is projected to grow by approximately 15%, reflecting the heightened awareness of quality standards among consumers and businesses alike. The integration of software solutions enables organizations to conduct thorough inspections, track compliance, and maintain high-quality outputs, thereby enhancing their competitive edge in the market.

Enhanced Data Analytics Capabilities

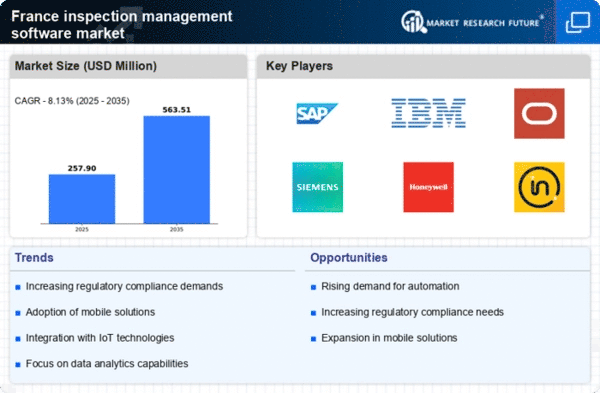

The inspection management-software market is witnessing a significant enhancement in data analytics capabilities, which is reshaping how inspections are conducted and managed. Advanced analytics tools integrated into inspection software allow organizations to derive actionable insights from inspection data, leading to improved operational efficiency and risk management. In France, the market is expected to grow by 18% as businesses leverage these capabilities to identify trends, predict potential issues, and optimize their inspection processes. The ability to analyze large volumes of data in real-time empowers organizations to make informed decisions, thereby enhancing their overall performance in the inspection management-software market.

Shift Towards Digital Transformation

The digital transformation wave sweeping across industries in France is significantly impacting the inspection management-software market. Organizations are increasingly adopting digital tools to replace traditional inspection methods, which often involve manual processes that are time-consuming and prone to errors. The shift towards digital solutions is expected to drive the market growth by approximately 20% in the coming years. This transformation allows for real-time data collection, analysis, and reporting, which enhances decision-making and operational efficiency. As businesses seek to optimize their inspection processes, the demand for innovative software solutions that facilitate digital workflows is likely to rise, positioning the inspection management-software market as a key player in the broader digital landscape.