Emphasis on Data-Driven Decision Making

In the context of the inspection management-software market, there is a growing emphasis on data-driven decision making among Canadian enterprises. Organizations are increasingly leveraging data analytics to enhance their inspection processes, leading to improved outcomes and reduced risks. The integration of data analytics tools within inspection management software allows companies to identify trends, predict potential issues, and make informed decisions. This shift is reflected in a 20% increase in the adoption of analytics-driven solutions within the market. As businesses aim to enhance their operational strategies, the ability to harness data effectively is becoming a critical factor in the selection of inspection management software. Consequently, this trend is likely to propel the market forward as organizations seek to capitalize on the insights derived from their inspection data.

Rising Demand for Operational Efficiency

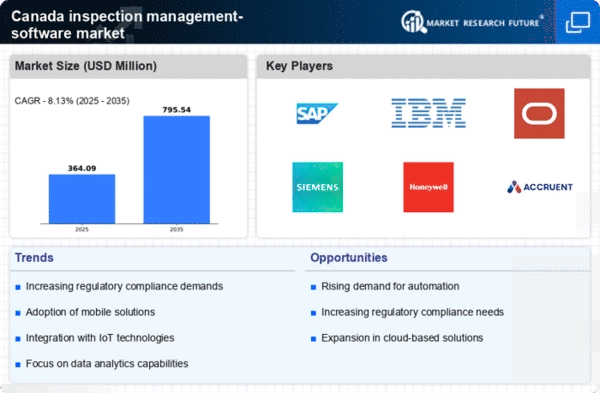

The inspection management-software market in Canada is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their inspection processes to reduce costs and enhance productivity. This trend is evidenced by a reported 15% increase in software adoption among Canadian businesses over the past year. Companies are seeking solutions that minimize manual errors and optimize resource allocation, thereby improving overall operational workflows. As industries such as construction, manufacturing, and healthcare continue to expand, the need for efficient inspection management becomes paramount. The ability to automate inspections and generate real-time reports is driving the growth of this market, as organizations strive to maintain competitiveness in a rapidly evolving landscape.

Growing Regulatory Compliance Requirements

The inspection management-software market is significantly influenced by the growing regulatory compliance requirements in Canada. Various industries, including food safety, construction, and environmental services, are subject to stringent regulations that necessitate thorough inspections and documentation. As compliance becomes increasingly complex, organizations are turning to specialized software solutions to ensure adherence to these regulations. The market has seen a 25% increase in demand for compliance-focused inspection management software, as businesses strive to avoid penalties and maintain their reputations. This trend underscores the importance of having robust inspection management systems that can facilitate compliance tracking and reporting, thereby driving growth in the market.

Increased Focus on Sustainability Practices

The inspection management-software market is witnessing an increased focus on sustainability practices among Canadian organizations. As environmental concerns gain prominence, businesses are seeking software solutions that facilitate sustainable inspection processes. This trend is evident in the growing demand for software that supports green initiatives, such as waste reduction and energy efficiency. A reported 18% increase in the adoption of sustainability-focused inspection management software highlights this shift. Companies are recognizing that effective inspection management can play a crucial role in achieving their sustainability goals. Consequently, this focus on sustainability is likely to drive innovation and growth within the inspection management-software market, as organizations strive to align their operations with environmentally responsible practices.

Technological Advancements in Mobile Solutions

Technological advancements in mobile solutions are reshaping the inspection management-software market in Canada. The proliferation of mobile devices has enabled inspectors to conduct inspections on-site, capturing data in real-time and enhancing the efficiency of the inspection process. This shift towards mobile solutions is reflected in a 30% increase in the adoption of mobile-compatible inspection management software among Canadian firms. The ability to access inspection data remotely and communicate findings instantly is proving invaluable for organizations aiming to improve their operational agility. As mobile technology continues to evolve, it is likely to further influence the market, encouraging more businesses to adopt mobile-friendly inspection management solutions.