Growing Awareness and Advocacy

The growing awareness and advocacy for Dravet syndrome are pivotal drivers for the dravet syndrome market. Patient advocacy groups and organizations are actively working to educate the public and healthcare professionals about the disorder. This heightened awareness is likely to lead to earlier diagnoses and increased demand for treatment options. Furthermore, advocacy efforts are pushing for policy changes that support research funding and access to therapies. As a result, the dravet syndrome market is expected to expand, as more patients seek effective treatments and support services, ultimately improving their quality of life.

Advancements in Genetic Research

Recent advancements in genetic research have significantly impacted the dravet syndrome market. The identification of specific genetic mutations associated with Dravet syndrome has opened new avenues for targeted therapies. This progress not only enhances understanding of the disorder but also facilitates the development of personalized medicine approaches. As a result, pharmaceutical companies are increasingly investing in research and development to create therapies that address the underlying genetic causes. The dravet syndrome market is likely to benefit from these innovations, as they may lead to more effective treatment options and improved patient outcomes, potentially increasing market size.

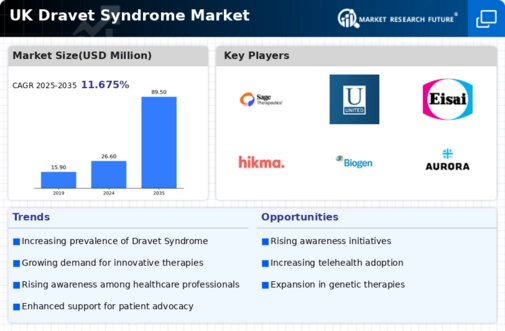

Rising Prevalence of Dravet Syndrome

The increasing incidence of Dravet syndrome in the UK is a notable driver for the dravet syndrome market. Recent estimates suggest that the prevalence of this rare genetic epilepsy disorder is approximately 1 in 15,700 live births. This rising prevalence is likely to lead to a greater demand for effective treatment options, thereby expanding the market. As awareness of Dravet syndrome grows among healthcare professionals and the public, more patients are being diagnosed, which could further stimulate market growth. The dravet syndrome market is thus positioned to respond to this increasing patient population by developing innovative therapies and improving access to existing treatments.

Increased Funding for Rare Disease Research

The dravet syndrome market is experiencing growth due to increased funding for research into rare diseases. In the UK, government and private sector investments in rare disease research have risen, with funding levels reaching approximately £1 billion annually. This financial support is crucial for advancing the understanding of Dravet syndrome and developing new therapies. As more resources are allocated to research initiatives, the potential for breakthroughs in treatment options increases. Consequently, the dravet syndrome market is likely to see a surge in innovative products and therapies, enhancing the overall landscape for patients and healthcare providers.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a significant driver for the dravet syndrome market. In the UK, regulatory bodies are increasingly prioritizing the approval of novel treatments for rare diseases, including Dravet syndrome. This supportive environment encourages pharmaceutical companies to invest in research and development, knowing that their products may receive expedited review processes. The potential for faster market entry of new therapies could lead to a more competitive landscape within the dravet syndrome market. As a result, patients may benefit from a wider array of treatment options, ultimately enhancing their management of the condition.