Advancements in Genetic Research

Advancements in genetic research are significantly influencing the Dravet Syndrome Market. The identification of specific genetic mutations associated with Dravet Syndrome Market has opened new avenues for targeted therapies. Research indicates that mutations in the SCN1A gene are responsible for a substantial percentage of cases, leading to the development of precision medicine approaches. These advancements not only enhance understanding of the disorder but also facilitate the creation of novel therapeutic agents tailored to the genetic profiles of patients. As a result, the market is witnessing an influx of innovative treatments that aim to address the underlying causes of the syndrome. This trend is likely to attract investment and interest from pharmaceutical companies, further propelling the growth of the Dravet Syndrome Market.

Rising Prevalence of Dravet Syndrome

The increasing prevalence of Dravet Syndrome Market is a notable driver in the Dravet Syndrome Market. Recent estimates suggest that Dravet Syndrome Market affects approximately 1 in 15,700 live births, leading to a growing patient population requiring specialized care. This rise in prevalence is likely to stimulate demand for innovative treatment options, thereby expanding the market. As awareness of the syndrome increases among healthcare professionals and families, more patients are being diagnosed, which further contributes to the market's growth. The need for effective therapies and management strategies for Dravet Syndrome Market is becoming increasingly urgent, as families seek solutions to improve the quality of life for affected individuals. Consequently, the Dravet Syndrome Market is poised for expansion as stakeholders respond to the rising demand for effective treatments.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a significant driver in the Dravet Syndrome Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for treatments targeting rare and severe conditions like Dravet Syndrome Market. Initiatives such as orphan drug designations and fast-track approvals are facilitating the entry of new therapies into the market. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of novel treatments, knowing that they may receive quicker access to market. As a result, the Dravet Syndrome Market is likely to benefit from a steady influx of innovative therapies that address unmet medical needs. The combination of regulatory support and the urgency of patient needs is expected to catalyze growth in this market.

Growing Patient Advocacy and Support Networks

Growing patient advocacy and support networks are playing a pivotal role in shaping the Dravet Syndrome Market. These organizations are dedicated to raising awareness, providing resources, and advocating for research funding and better treatment options for individuals affected by Dravet Syndrome Market. Their efforts are instrumental in educating both the public and healthcare professionals about the challenges faced by patients and families. Increased advocacy leads to heightened visibility of the condition, which may result in more accurate diagnoses and improved access to care. Furthermore, these networks often collaborate with pharmaceutical companies and researchers to facilitate clinical trials and gather patient data. As advocacy efforts continue to expand, the Dravet Syndrome Market is likely to see enhanced engagement from stakeholders, ultimately driving growth and innovation.

Increased Investment in Research and Development

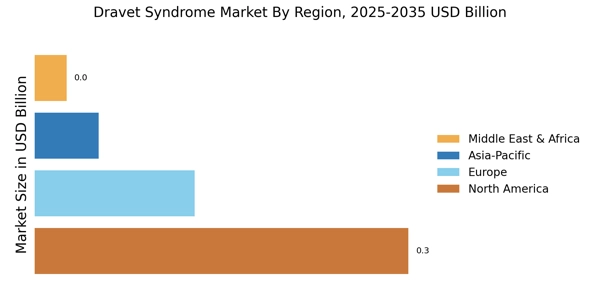

Increased investment in research and development is a critical driver for the Dravet Syndrome Market. Pharmaceutical companies and research institutions are allocating substantial resources to explore new treatment modalities, including gene therapy and novel anticonvulsants. This surge in funding is indicative of the growing recognition of Dravet Syndrome Market as a serious health concern that requires urgent attention. According to recent data, the global market for epilepsy treatments, which includes Dravet Syndrome Market, is projected to reach several billion dollars by the end of the decade. This financial commitment to R&D is likely to yield breakthroughs in treatment options, thereby enhancing the therapeutic landscape for patients with Dravet Syndrome Market. As new therapies emerge, the Dravet Syndrome Market is expected to experience robust growth, driven by the demand for effective and innovative solutions.