Technological Innovations

Technological advancements play a pivotal role in shaping the continuous glucose-monitoring-system market. Innovations such as improved sensor technology, enhanced data analytics, and integration with mobile applications are transforming how patients monitor their glucose levels. For instance, the introduction of non-invasive monitoring devices is gaining traction, appealing to patients who prefer less intrusive methods. Furthermore, the market is witnessing the development of smart devices that can sync with smartphones, providing users with real-time data and alerts. This integration of technology not only enhances user experience but also encourages adherence to monitoring regimens. As these innovations continue to evolve, they are expected to significantly impact the continuous glucose-monitoring-system market, making it more accessible and user-friendly.

Increased Health Awareness

The continuous glucose-monitoring-system market is benefiting from a growing awareness of health and wellness among the UK population. As individuals become more conscious of their health, there is a rising demand for tools that facilitate better management of chronic conditions such as diabetes. Educational campaigns and initiatives by healthcare professionals are contributing to this trend, highlighting the importance of regular glucose monitoring. This heightened awareness is leading to increased adoption of continuous glucose monitoring systems, as patients seek to take proactive steps in managing their health. Consequently, the continuous glucose-monitoring-system market is likely to expand as more individuals recognize the value of these devices in maintaining optimal health.

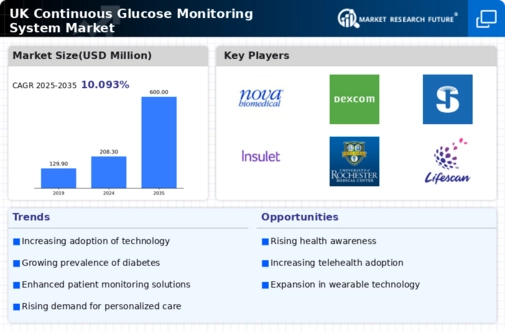

Rising Diabetes Prevalence

The continuous glucose-monitoring-system market is experiencing growth due to the increasing prevalence of diabetes in the UK. Recent statistics indicate that approximately 4.9 million people are living with diabetes in the UK, a figure that is projected to rise. This surge in diabetes cases necessitates effective management solutions, thereby driving demand for continuous glucose monitoring systems. These devices provide real-time glucose data, enabling patients to make informed decisions about their health. As awareness of diabetes management improves, healthcare providers are increasingly recommending continuous glucose monitoring as a standard practice. This trend is likely to continue, further propelling the continuous glucose-monitoring-system market as more individuals seek to manage their condition effectively.

Supportive Regulatory Environment

A supportive regulatory environment is fostering growth in the continuous glucose-monitoring-system market. The UK government has implemented various policies aimed at improving healthcare access and promoting innovative medical technologies. Regulatory bodies are streamlining the approval processes for new devices, which encourages manufacturers to invest in research and development. This proactive approach not only enhances the availability of advanced continuous glucose monitoring systems but also instills confidence among consumers regarding the safety and efficacy of these products. As regulations continue to evolve in favor of innovation, the continuous glucose-monitoring-system market is poised for further expansion, benefiting both manufacturers and patients alike.

Rising Demand for Remote Patient Monitoring

The continuous glucose monitoring system market is witnessing a surge in demand for remote patient monitoring solutions. With the increasing emphasis on telehealth and remote healthcare services, patients are seeking ways to manage their diabetes from home. Continuous glucose monitoring systems offer a convenient solution, allowing users to track their glucose levels without frequent clinic visits. This trend is particularly relevant in the context of the UK's healthcare system, which is increasingly adopting digital health solutions. As healthcare providers recognize the benefits of remote monitoring in improving patient outcomes, the continuous glucose-monitoring-system market is likely to see sustained growth, driven by the need for accessible and efficient diabetes management solutions.