Technological Innovations

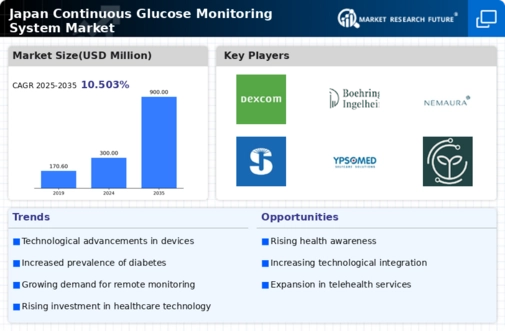

Technological innovations play a pivotal role in shaping the continuous glucose-monitoring-system market in Japan. The introduction of advanced sensors and mobile applications has enhanced the user experience, making glucose monitoring more accessible and efficient. For instance, the integration of real-time data sharing with healthcare professionals allows for timely interventions, which is crucial for diabetes management. The market is also witnessing the emergence of non-invasive monitoring technologies, which could potentially attract a broader user base. As these innovations continue to evolve, they are expected to drive market growth, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next five years. This trend indicates a promising future for the continuous glucose-monitoring-system market.

Rising Diabetes Prevalence

The continuous glucose monitoring system market in Japan is experiencing growth due to the rising prevalence of diabetes. According to recent health statistics, approximately 7.4 million individuals in Japan are diagnosed with diabetes, which translates to about 7.5% of the adult population. This increasing number of patients necessitates effective management solutions, thereby driving demand for continuous glucose monitoring systems. The market is projected to expand as healthcare providers and patients seek advanced technologies to monitor glucose levels more accurately. Furthermore, the aging population in Japan, which is more susceptible to diabetes, further amplifies the need for innovative monitoring solutions. As a result, The continuous glucose monitoring system market is likely to see sustained growth in response to these demographic trends.

Increased Investment in Healthcare

Investment in healthcare infrastructure is a significant driver for the continuous glucose-monitoring-system market in Japan. The government has been allocating substantial funds to enhance healthcare services, particularly in diabetes management. Recent reports indicate that healthcare expenditure in Japan is projected to reach approximately $500 billion by 2026, with a notable portion directed towards innovative medical technologies. This financial commitment is likely to facilitate the adoption of continuous glucose monitoring systems, as healthcare providers seek to improve patient outcomes. Additionally, private sector investments in research and development are expected to yield new products and solutions, further stimulating market growth. The continuous glucose-monitoring-system market stands to benefit from this influx of capital and innovation.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is influencing the continuous glucose-monitoring-system market in Japan. Patients are increasingly seeking tailored healthcare solutions that cater to their specific needs, particularly in managing chronic conditions like diabetes. This trend is prompting manufacturers to develop customizable monitoring systems that provide individualized data and insights. The continuous glucose-monitoring-system market is likely to expand as healthcare providers adopt these personalized approaches, enhancing patient engagement and adherence to treatment plans. Furthermore, the integration of artificial intelligence in data analysis could lead to more precise recommendations for patients, thereby improving overall health outcomes. This evolving landscape suggests a promising trajectory for the continuous glucose-monitoring-system market.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the Japanese population, which is positively impacting the continuous glucose-monitoring-system market. As individuals become more conscious of their health and the risks associated with diabetes, there is an increasing demand for proactive monitoring solutions. Educational campaigns and health initiatives have contributed to this awareness, encouraging people to take charge of their health. The continuous glucose-monitoring-system market is likely to benefit from this trend, as more consumers seek out devices that enable them to monitor their glucose levels regularly. This shift towards preventive healthcare could lead to a broader acceptance of continuous glucose monitoring systems, ultimately driving market growth.