Rising Diabetes Prevalence

The continuous glucose-monitoring-system market is experiencing growth due to the increasing prevalence of diabetes in South Korea. Recent statistics indicate that approximately 13.4% of the adult population is affected by diabetes, leading to a heightened demand for effective management solutions. This trend is further exacerbated by an aging population, as older adults are more susceptible to developing diabetes. Consequently, healthcare providers and patients are increasingly turning to continuous glucose monitoring systems as a means to enhance glycemic control and reduce the risk of complications. The market is projected to expand as more individuals seek innovative technologies to manage their condition effectively.

Government Initiatives and Support

Government initiatives aimed at improving diabetes care are significantly influencing the continuous glucose-monitoring-system market. In South Korea, the government has implemented various policies to promote the adoption of advanced medical technologies, including subsidies for diabetes management tools. These initiatives are designed to alleviate the financial burden on patients and encourage the use of continuous glucose monitoring systems. As a result, the market is likely to witness increased penetration of these devices, particularly among low-income populations. The government's commitment to enhancing healthcare access and quality is expected to drive market growth in the coming years.

Technological Innovations in Devices

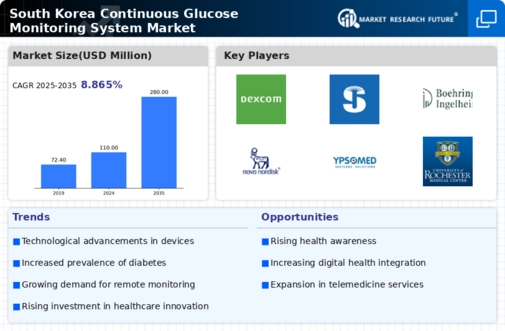

Technological innovations are playing a crucial role in shaping the continuous glucose-monitoring-system market. Recent advancements in sensor technology, data analytics, and mobile applications have led to the development of more accurate and user-friendly devices. For instance, the introduction of real-time glucose monitoring systems with integrated smartphone applications has made it easier for users to track their glucose levels and receive alerts. This trend is likely to attract a broader consumer base, including younger individuals who are tech-savvy and prefer digital solutions for health management. As these innovations continue to evolve, the market is expected to expand further.

Increased Focus on Preventive Healthcare

The continuous glucose-monitoring-system market is also influenced by the rising focus on preventive healthcare in South Korea. As healthcare systems shift towards proactive management of chronic diseases, there is a growing recognition of the importance of early detection and intervention in diabetes care. Continuous glucose monitoring systems enable patients to monitor their glucose levels consistently, facilitating timely adjustments to their diet and lifestyle. This preventive approach not only helps in managing diabetes but also reduces the overall healthcare costs associated with diabetes-related complications. The market is expected to grow as more individuals adopt preventive measures to maintain their health.

Growing Demand for Personalized Healthcare

The continuous glucose-monitoring-system market is benefiting from the growing demand for personalized healthcare solutions. Patients are increasingly seeking tailored approaches to diabetes management that consider their unique lifestyles and health conditions. Continuous glucose monitoring systems offer real-time data that can be customized to individual needs, allowing for more effective treatment plans. This shift towards personalized healthcare is supported by healthcare professionals who recognize the importance of individualized care in improving patient outcomes. As awareness of personalized medicine grows, the market is likely to see a surge in demand for continuous glucose monitoring systems.