Supportive Regulatory Environment

The regulatory landscape in the UK is becoming increasingly supportive of the atherectomy devices market. Regulatory bodies are streamlining the approval processes for new medical devices, which facilitates quicker access to innovative atherectomy technologies. This supportive environment encourages manufacturers to invest in the development of new devices, knowing that they can bring their products to market more efficiently. Additionally, the UK government has been promoting initiatives aimed at improving cardiovascular health, which further bolsters the market. As a result, the atherectomy devices market is expected to benefit from this regulatory support, potentially leading to a 10% increase in market growth over the next few years.

Advancements in Medical Technology

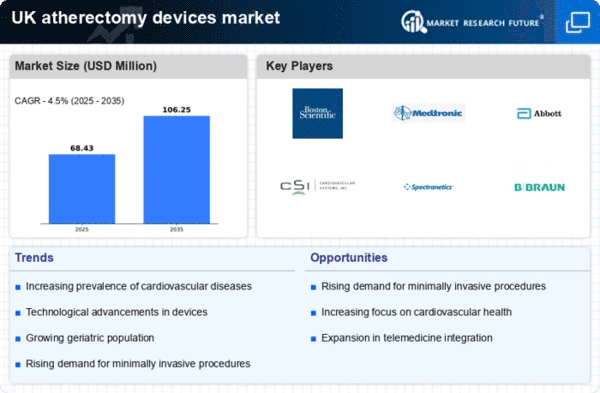

Technological innovations play a crucial role in shaping the atherectomy devices market. The introduction of advanced devices, such as laser and rotational atherectomy systems, enhances the efficacy and safety of procedures. These innovations allow for more precise plaque removal, reducing the risk of complications and improving recovery times for patients. The UK healthcare system is increasingly adopting these advanced technologies, as they align with the growing emphasis on minimally invasive procedures. Market data indicates that the atherectomy devices market is projected to grow at a CAGR of around 8% over the next few years, driven by these technological advancements. As manufacturers continue to invest in research and development, the market is likely to see the emergence of even more sophisticated devices.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the UK is another significant driver for the atherectomy devices market. The government and private sector are increasingly allocating funds to enhance medical facilities and upgrade existing equipment. This investment is crucial for the adoption of advanced medical technologies, including atherectomy devices. Enhanced healthcare infrastructure not only improves access to treatment but also ensures that healthcare providers are equipped with the latest technologies. Market data indicates that the UK healthcare expenditure is projected to rise by approximately 5% annually, which is likely to positively impact the atherectomy devices market. As facilities upgrade their capabilities, the demand for atherectomy devices is expected to increase correspondingly.

Increasing Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in the UK is a primary driver for the atherectomy devices market. As the population ages, the prevalence of conditions such as atherosclerosis and coronary artery disease escalates. According to recent health statistics, cardiovascular diseases account for approximately 27% of all deaths in the UK, underscoring the urgent need for effective treatment options. Atherectomy devices, which facilitate the removal of plaque from arteries, are increasingly being adopted in clinical settings. This trend is likely to continue, as healthcare providers seek to improve patient outcomes and reduce the burden of cardiovascular diseases. The atherectomy devices market is expected to witness substantial growth, driven by the demand for innovative solutions that address these pressing health challenges.

Rising Awareness of Minimally Invasive Treatments

There is a growing awareness among both healthcare professionals and patients regarding the benefits of minimally invasive treatments. This trend is significantly impacting the atherectomy devices market, as these devices are designed to minimize patient trauma and enhance recovery. The UK population is increasingly seeking alternatives to traditional surgical methods, which often involve longer recovery times and higher risks. As a result, healthcare providers are more inclined to adopt atherectomy devices in their treatment protocols. Market analysis suggests that the demand for minimally invasive procedures is expected to rise, potentially leading to a 15% increase in the adoption of atherectomy devices over the next five years. This shift in patient preference is likely to drive market growth.