Investment in Healthcare Infrastructure

The Italian government has been investing in healthcare infrastructure, which is expected to bolster the atherectomy devices market. Enhanced facilities and improved access to advanced medical technologies are likely to facilitate the adoption of atherectomy procedures. Recent reports suggest that healthcare spending in Italy has increased by approximately 5% annually, with a focus on upgrading medical equipment and technologies. This investment is anticipated to create a conducive environment for the growth of the atherectomy devices market, as hospitals and clinics are better equipped to perform these specialized procedures.

Aging Population and Associated Health Issues

Italy's demographic shift towards an aging population is a critical factor influencing the atherectomy devices market. As individuals age, the incidence of cardiovascular diseases tends to increase, necessitating effective treatment options. The Italian National Institute of Statistics indicates that by 2030, over 25% of the population will be aged 65 and older. This demographic change is expected to drive demand for atherectomy devices, as healthcare providers seek to address the rising prevalence of arterial blockages and other related conditions. Consequently, the atherectomy devices market is poised for expansion in response to these evolving healthcare needs.

Rising Incidence of Lifestyle-Related Diseases

The increasing prevalence of lifestyle-related diseases in Italy is a significant driver for the atherectomy devices market. Factors such as poor diet, lack of physical activity, and high stress levels contribute to the rise of conditions like obesity and diabetes, which are closely linked to cardiovascular issues. Data indicates that nearly 40% of the Italian population is classified as overweight or obese, leading to a higher demand for effective treatment options. Consequently, the atherectomy devices market is likely to expand as healthcare providers seek to address the complications arising from these lifestyle-related diseases.

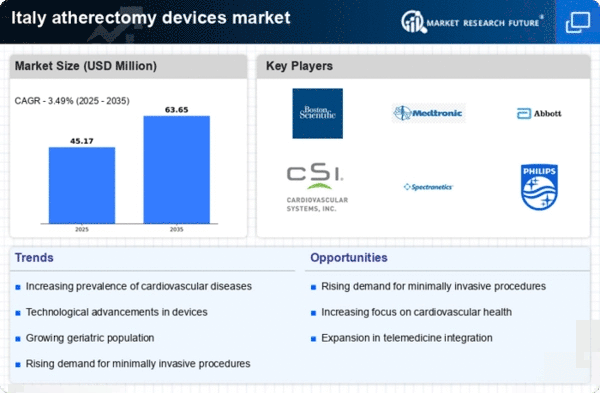

Increasing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive surgical techniques is a notable driver in the atherectomy devices market. Patients and healthcare providers in Italy are increasingly opting for procedures that promise reduced recovery times and lower complication rates. This trend is supported by advancements in technology that enhance the efficacy of atherectomy devices. According to recent data, minimally invasive procedures have seen a rise in adoption by approximately 30% over the past few years. As a result, the atherectomy devices market is likely to experience significant growth, as these devices are integral to performing such procedures effectively.

Enhanced Awareness and Education on Cardiovascular Health

There is a growing awareness regarding cardiovascular health among the Italian population, which is positively impacting the atherectomy devices market. Educational campaigns and initiatives by healthcare organizations have led to increased public knowledge about the risks associated with cardiovascular diseases. This heightened awareness is likely to result in more individuals seeking medical advice and treatment options, including atherectomy procedures. As a result, the market may witness a surge in demand for atherectomy devices, as patients become more proactive in managing their cardiovascular health.