Uav Battery Size

Market Size Snapshot

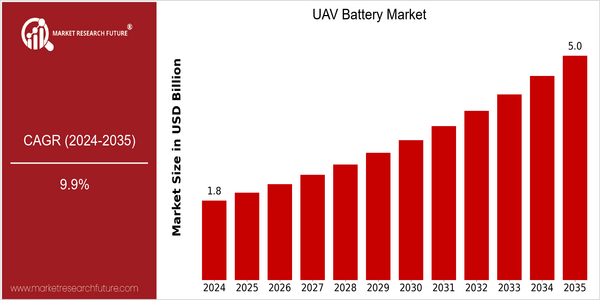

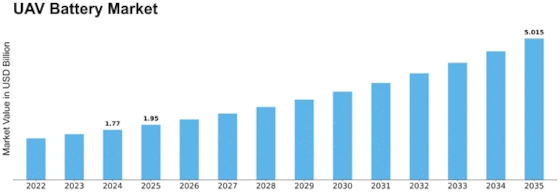

| Year | Value |

|---|---|

| 2024 | USD 1.77 Billion |

| 2035 | USD 5.0 Billion |

| CAGR (2025-2035) | 9.9 % |

Note – Market size depicts the revenue generated over the financial year

The UAV battery market is poised for significant growth, with a current valuation of USD 1.77 billion in 2024, projected to reach USD 5.0 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 9.9% from 2025 to 2035. The increasing adoption of unmanned aerial vehicles across various sectors, including agriculture, logistics, and surveillance, is a primary driver of this market expansion. As industries seek to enhance operational efficiency and reduce costs, the demand for advanced battery technologies that offer longer flight times and faster charging capabilities is surging.

Technological advancements, such as the development of lithium-sulfur and solid-state batteries, are further propelling the market forward. These innovations not only improve energy density but also enhance safety and longevity, making them attractive options for UAV manufacturers. Key players in the UAV battery market, including companies like DJI, Panasonic, and Tesla, are actively investing in research and development, forming strategic partnerships, and launching new products to capitalize on this growing demand. For instance, DJI's recent introduction of high-capacity batteries for its drone models exemplifies the industry's focus on enhancing performance and user experience, thereby solidifying its position in the competitive landscape.

Regional Market Size

Regional Deep Dive

The UAV Battery Market is experiencing significant growth across various regions, driven by advancements in drone technology, increasing applications in commercial and military sectors, and a growing emphasis on sustainable energy solutions. Each region exhibits unique characteristics influenced by local regulations, technological innovations, and market demands. North America leads in technological advancements and military applications, while Europe focuses on regulatory frameworks and environmental sustainability. Asia-Pacific is rapidly expanding due to manufacturing capabilities and increasing adoption in agriculture and logistics. The Middle East and Africa are witnessing growth through government initiatives and investments in drone technology, while Latin America is exploring UAV applications in agriculture and surveillance.

Europe

- The European Union's Green Deal is promoting the use of sustainable energy sources, leading to increased investments in eco-friendly UAV battery technologies, particularly lithium-sulfur and solid-state batteries.

- Organizations such as the European Union Aviation Safety Agency (EASA) are establishing stringent regulations for UAV operations, which are shaping the battery specifications and safety standards required for market entry.

Asia Pacific

- China is rapidly advancing its UAV battery technology, with companies like BYD and CATL leading the charge in developing high-capacity lithium batteries tailored for drone applications.

- The region is witnessing a surge in agricultural UAV applications, particularly in countries like India and Japan, where UAV batteries are being optimized for longer flight times to enhance crop monitoring and pesticide spraying.

Latin America

- Countries like Brazil and Argentina are exploring UAV applications in agriculture, leading to increased demand for specialized UAV batteries that can withstand the rigors of fieldwork.

- Regulatory bodies in Latin America are beginning to establish frameworks for UAV operations, which will likely influence the types of battery technologies that gain traction in the market.

North America

- The Federal Aviation Administration (FAA) has recently updated regulations to facilitate the integration of UAVs into the national airspace, which is expected to boost the demand for UAV batteries as more commercial applications emerge.

- Companies like DJI and Northrop Grumman are investing heavily in R&D for battery technology, focusing on increasing energy density and reducing charging times, which will enhance the operational efficiency of UAVs.

Middle East And Africa

- Governments in the UAE and Saudi Arabia are investing in drone technology as part of their Vision 2030 initiatives, which is expected to drive demand for advanced UAV batteries in various sectors, including logistics and surveillance.

- Local startups are emerging in the UAV battery space, focusing on developing solutions that cater to the unique environmental conditions of the region, such as high temperatures and dust.

Did You Know?

“Did you know that the energy density of lithium-sulfur batteries, which are being developed for UAVs, can potentially reach up to five times that of traditional lithium-ion batteries?” — Journal of Power Sources

Segmental Market Size

The UAV Battery Market is experiencing robust growth, driven by the increasing demand for unmanned aerial vehicles across various sectors, including agriculture, logistics, and surveillance. Key factors propelling this segment include advancements in battery technology, such as lithium polymer and solid-state batteries, which enhance energy density and reduce charging times. Additionally, regulatory policies promoting drone usage for commercial applications further stimulate demand, particularly in regions like North America and Europe, where drone regulations are becoming more favorable.

Currently, the market is in a scaled deployment stage, with companies like DJI and Parrot leading in the adoption of advanced battery solutions for their UAVs. Primary applications include aerial photography, precision agriculture, and infrastructure inspection, where reliable battery performance is critical. Trends such as sustainability initiatives and the push for greener technologies are accelerating growth, as manufacturers focus on developing eco-friendly battery solutions. Furthermore, innovations in battery management systems and energy recovery technologies are shaping the segment's evolution, ensuring longer flight times and improved operational efficiency.

Future Outlook

The UAV Battery Market is poised for significant growth from 2024 to 2035, with the market value projected to increase from $1.77 billion to $5.0 billion, reflecting a robust compound annual growth rate (CAGR) of 9.9%. This growth trajectory is driven by the increasing adoption of unmanned aerial vehicles across various sectors, including agriculture, logistics, and surveillance. As industries seek to enhance operational efficiency and reduce costs, the demand for high-performance, lightweight, and long-lasting battery solutions will continue to rise, leading to greater market penetration and usage rates. By 2035, it is anticipated that UAVs equipped with advanced battery technologies will account for over 60% of the total UAV fleet, underscoring the critical role of battery innovation in the sector's evolution.

Key technological advancements, such as the development of lithium-sulfur and solid-state batteries, are expected to revolutionize the UAV battery landscape, offering higher energy densities and improved safety profiles. Additionally, supportive government policies aimed at promoting drone usage for commercial applications will further catalyze market growth. Emerging trends, including the integration of renewable energy sources for battery charging and the rise of hybrid UAV systems, will also shape the future of the market. As stakeholders continue to invest in research and development, the UAV Battery Market is set to become a cornerstone of the broader UAV ecosystem, driving innovation and sustainability in aerial operations.

Leave a Comment