Strategic Geographic Location

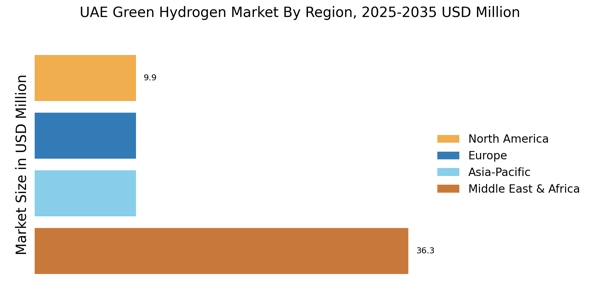

The UAE Green Hydrogen Market is strategically positioned due to the UAE's geographic advantages. Located at the crossroads of Europe, Asia, and Africa, the UAE serves as a pivotal hub for hydrogen exportation. The proximity to key markets, such as Europe, which is increasingly seeking green hydrogen to meet its energy transition goals, enhances the potential for trade. The UAE's extensive port infrastructure and logistics capabilities further facilitate the export of green hydrogen. As countries in Europe and Asia ramp up their hydrogen consumption, the UAE green hydrogen market is likely to experience substantial growth, driven by its advantageous location and established trade routes.

Collaborations and Partnerships

Collaborations and partnerships within the UAE Green Hydrogen Market are essential for driving innovation and scaling production. The UAE has established strategic alliances with various international companies and research institutions to enhance its hydrogen capabilities. For example, partnerships with European firms focus on developing hydrogen infrastructure and technology transfer. These collaborations not only facilitate knowledge sharing but also attract foreign investment into the UAE green hydrogen market. As the region continues to build its hydrogen ecosystem, such partnerships are likely to accelerate the development and commercialization of green hydrogen projects, further solidifying the UAE's position as a leader in the global hydrogen economy.

Rising Global Demand for Clean Energy

The UAE Green Hydrogen Market is poised for growth due to the rising global demand for clean energy solutions. As countries worldwide commit to reducing carbon emissions and transitioning to sustainable energy sources, the demand for green hydrogen is expected to surge. The International Energy Agency projects that global hydrogen demand could reach 500 million tons by 2050, with a significant portion coming from green hydrogen. The UAE, with its abundant renewable energy resources, is well-positioned to meet this demand. This trend indicates a promising future for the UAE green hydrogen market, as it aligns with The uae green hydrogen market.

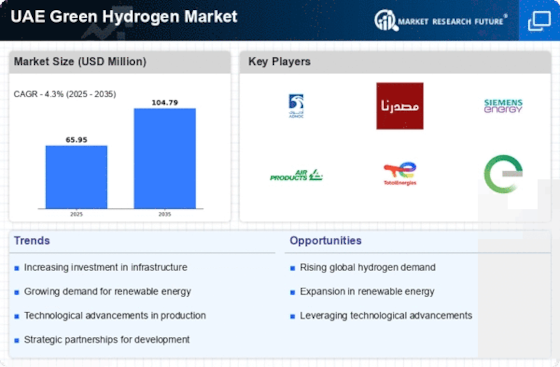

Government Initiatives and Investments

The UAE Green Hydrogen Market benefits from robust government initiatives aimed at fostering a sustainable energy landscape. The UAE government has committed to investing over USD 160 billion in clean energy projects by 2050, which includes significant allocations for green hydrogen production. This commitment is reflected in the UAE Energy Strategy 2050, which emphasizes the diversification of energy sources and the reduction of carbon emissions. The establishment of the Hydrogen Leadership Team in 2021 further underscores the strategic importance of hydrogen in the national energy mix. Such initiatives not only enhance the UAE green hydrogen market but also position the region as a global leader in hydrogen production and export.

Technological Innovations in Hydrogen Production

Technological advancements play a crucial role in the UAE Green Hydrogen Market, particularly in the production of hydrogen through electrolysis and other methods. The UAE has invested in cutting-edge technologies that enhance the efficiency and reduce the costs associated with green hydrogen production. For instance, the development of large-scale solar projects, such as the Mohammed bin Rashid Al Maktoum Solar Park, supports the generation of renewable energy required for electrolysis. As of 2025, the cost of green hydrogen production in the UAE is projected to decrease significantly, making it more competitive in the global market. These innovations not only bolster the UAE green hydrogen market but also contribute to the overall sustainability goals of the region.