Hydrogen Fuel Cells Market Summary

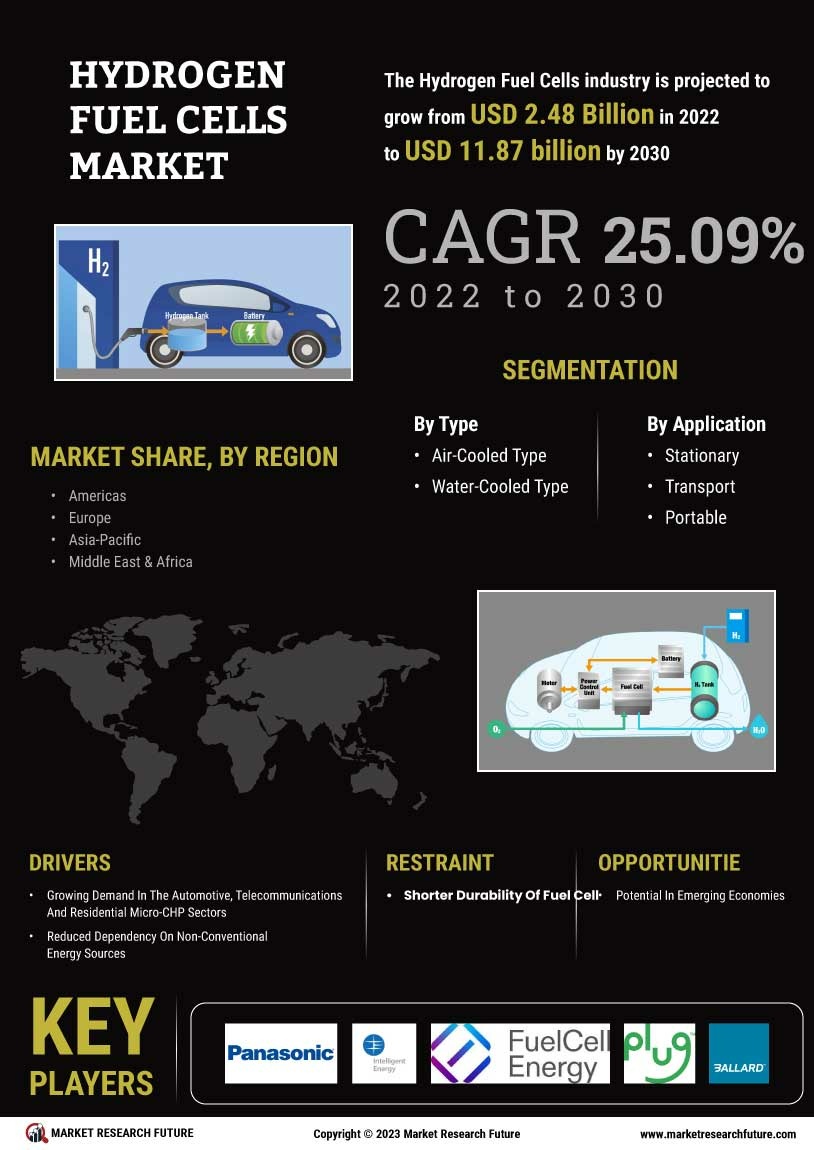

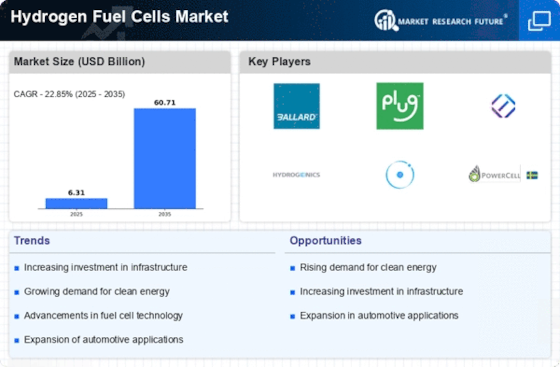

As per Market Research Future analysis, the Hydrogen Fuel Cells Market Size was estimated at 6.31 USD Billion in 2024. The Hydrogen Fuel Cells industry is projected to grow from 7.752 USD Billion in 2025 to 60.71 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 22.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Hydrogen Fuel Cells Market is poised for substantial growth driven by technological advancements and increasing demand for clean energy solutions.

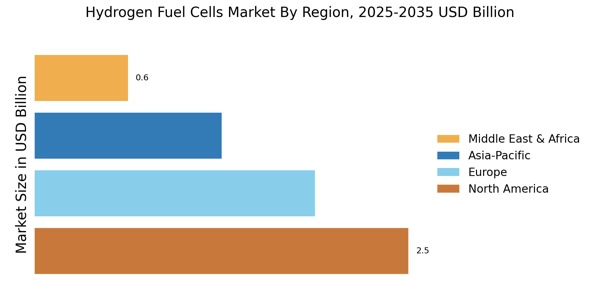

- The market experiences a rising demand for clean energy solutions, particularly in North America, which remains the largest market.

- Technological advancements in fuel cell efficiency are enhancing the performance and viability of hydrogen fuel cells across various applications.

- Strategic collaborations in the automotive sector are fostering innovation and expanding the adoption of hydrogen fuel cells, especially in the Asia-Pacific region.

- Key market drivers include increasing investment in hydrogen infrastructure and growing environmental regulations that support the transition to cleaner energy sources.

Market Size & Forecast

| 2024 Market Size | 6.31 (USD Billion) |

| 2035 Market Size | 60.71 (USD Billion) |

| CAGR (2025 - 2035) | 22.85% |

Major Players

Ballard Power Systems (CA), Plug Power (US), FuelCell Energy (US), Hydrogenics (CA), ITM Power (GB), PowerCell Sweden AB (SE), Ceres Media (GB), Nel ASA (NO), Air Products and Chemicals (US), Siemens AG (DE)