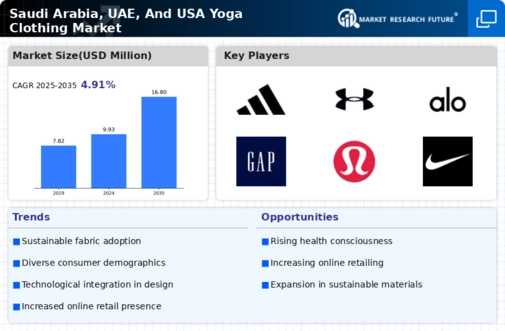

Growing Health Consciousness

The GCC Yoga Clothing Market is experiencing a notable surge in demand driven by an increasing awareness of health and wellness among the population. As more individuals prioritize physical fitness and mental well-being, yoga has emerged as a popular practice. This trend is reflected in the rising participation rates in yoga classes and workshops across the GCC region. According to recent surveys, approximately 30% of the population in the GCC engages in regular physical activity, with yoga being a preferred choice. This growing health consciousness is prompting consumers to invest in high-quality yoga apparel, thereby propelling the growth of the GCC Yoga Clothing Market. Brands are responding by offering innovative designs and functional materials that cater to the needs of health-conscious consumers.

Rise of E-commerce Platforms

The GCC Yoga Clothing Market is witnessing a transformation due to the rise of e-commerce platforms. With the increasing penetration of the internet and smartphone usage, consumers are increasingly turning to online shopping for their yoga apparel needs. E-commerce platforms provide a convenient shopping experience, allowing consumers to access a wide range of products from various brands. Recent data indicates that online retail sales in the GCC region have grown by over 20% annually, with fitness apparel being a significant category. This shift towards online shopping is likely to enhance the visibility and accessibility of yoga clothing, thereby driving growth in the GCC Yoga Clothing Market.

Sustainability Trends in Fashion

The GCC Yoga Clothing Market is increasingly aligning with global sustainability trends, as consumers become more environmentally conscious. There is a growing demand for yoga apparel made from sustainable materials, such as organic cotton and recycled fabrics. This shift is prompting brands to adopt eco-friendly practices in their production processes. Recent studies indicate that approximately 40% of consumers in the GCC are willing to pay a premium for sustainable products. As a result, the GCC Yoga Clothing Market is likely to see a rise in the availability of sustainable yoga clothing options, catering to the preferences of environmentally aware consumers.

Influence of Celebrity Endorsements

The GCC Yoga Clothing Market is significantly influenced by celebrity endorsements and the growing popularity of fitness influencers. As public figures promote yoga and healthy lifestyles, their followers are often inspired to adopt similar practices. This trend has led to an increased demand for yoga apparel that aligns with the styles and preferences of these influencers. Brands are leveraging this phenomenon by collaborating with celebrities to create exclusive yoga clothing lines. This strategy not only enhances brand visibility but also drives consumer interest in yoga apparel, contributing to the expansion of the GCC Yoga Clothing Market.

Government Initiatives Promoting Fitness

The GCC Yoga Clothing Market is benefiting from various government initiatives aimed at promoting fitness and healthy lifestyles. Governments in the region are increasingly recognizing the importance of physical activity in enhancing public health. For instance, initiatives such as the UAE's National Sports Strategy aim to encourage citizens to engage in sports and fitness activities, including yoga. These policies not only foster a culture of health but also stimulate demand for yoga-related products, including clothing. As a result, the GCC Yoga Clothing Market is likely to see a boost in sales as more individuals participate in yoga and seek appropriate apparel to support their practice.