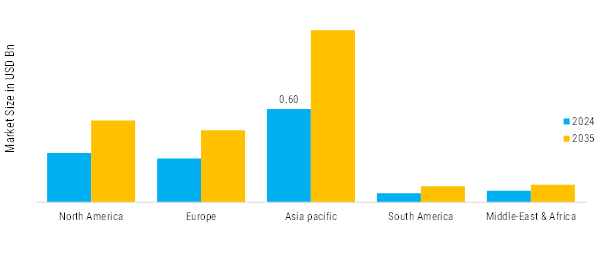

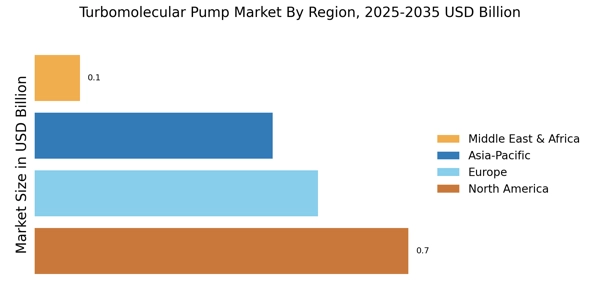

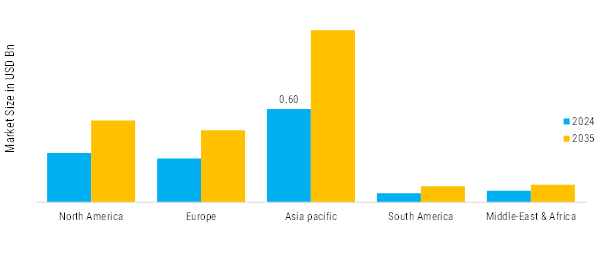

Asia-Pacific: Based on region, the Turbomolecular Pump Market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East and Africa. Asia-Pacific accounted for the largest market share in 2024, driven by its dominant position in semiconductor manufacturing, electronics production, and advanced industrial processing. The market in Asia-Pacific was valued at USD 0.60 billion in 2024 and is anticipated to reach USD 1.10 billion by 2035, registering the highest growth rate among all regions during the forecast period. Strong demand from China, Japan, South Korea, and India, coupled with large-scale investments in semiconductor fabs, cleanroom facilities, and research infrastructure, continues to reinforce the region’s leadership. Government-supported industrialization initiatives and rapid adoption of automation further strengthen market expansion.

North America: It represents a mature and technologically advanced market, supported by strong demand from semiconductor fabrication, aerospace and defence testing, scientific research laboratories, and analytical instrumentation. The region benefits from established manufacturing ecosystems, high R&D spending, and early adoption of high- and ultra-high-vacuum technologies. Continuous upgrades of existing facilities and stable investment in advanced technologies sustain market growth.

Europe: The turbomolecular pump market in Europe is characterised by steady growth, driven by precision manufacturing, electronics production, and a strong focus on research and development. Stringent quality and environmental standards, along with the region’s emphasis on energy-efficient and contamination-free processes, support sustained adoption. Europe’s well-developed industrial supply chain and research infrastructure further contribute to market expansion.

South America: It holds a developing yet notable position in the Turbomolecular Pump Market, supported by gradual industrialization and expanding adoption of advanced manufacturing and analytical technologies. The region benefits from growing electronics assembly, industrial processing, and research activities, particularly in countries such as Brazil and Argentina. Improvements in industrial supply chains, rising investment in scientific laboratories, and increasing use of vacuum-based testing and coating systems are supporting market growth. Although the market remains smaller compared to Asia-Pacific and North America, steady progress in industrial infrastructure and technology adoption continues to strengthen regional demand.

Middle East & Africa: It represents an emerging market for turbomolecular pumps, supported by increasing investments in industrial diversification, research infrastructure, and advanced technology adoption. Growth is driven by expanding scientific laboratories, healthcare research facilities, and industrial processing applications that require high- and ultra-high-vacuum environments. Countries in the Gulf region are investing in electronics manufacturing, cleanroom facilities, and research and development centres as part of broader economic diversification strategies. Additionally, the energy sector’s focus on advanced materials testing, analytical instrumentation, and specialised vacuum applications is contributing to market demand. While adoption levels remain lower compared to Asia-Pacific and North America, ongoing improvements in technical infrastructure, education, and research capabilities are expected to support steady long-term growth of the turbomolecular pump market across the Middle East & Africa region.

Further, the major countries studied in the market report are the U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Sweden, Turkey, Russia, Rest of the Europe, China, India, Japan, South Korea, Indonesia, Malaysia, Australia, Rest of the APAC, GCC Countries, South Africa, Rest of MEA.