Increased Focus on Data Analytics

The Truck Telematics Market is increasingly characterized by a focus on data analytics and its applications in fleet management. The ability to collect and analyze data from various sources is becoming essential for making informed business decisions. Companies are leveraging telematics data to gain insights into driver behavior, vehicle performance, and operational efficiency. This analytical approach enables organizations to identify trends, optimize routes, and reduce costs. The market is projected to grow as businesses recognize the value of data-driven decision-making in enhancing their competitive edge. Furthermore, the integration of advanced analytics tools within telematics systems is likely to drive innovation in the Truck Telematics Market, fostering a culture of continuous improvement and operational excellence.

Growing Emphasis on Sustainability

The Truck Telematics Market is witnessing a growing emphasis on sustainability and environmental responsibility. Companies are increasingly adopting telematics solutions to monitor and reduce their carbon footprints. By optimizing routes and improving fuel efficiency, telematics can contribute to lower emissions, aligning with global sustainability goals. Recent studies indicate that telematics can help reduce greenhouse gas emissions by up to 10%. This shift towards sustainable practices is not only driven by regulatory pressures but also by consumer demand for environmentally friendly logistics solutions. As a result, the Truck Telematics Market is likely to see a rise in the adoption of telematics systems that support sustainability initiatives, thereby enhancing corporate social responsibility.

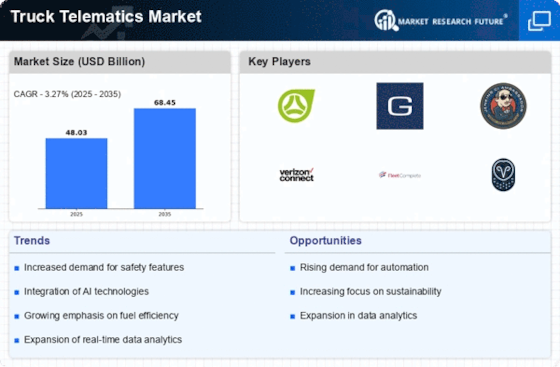

Rising Demand for Fleet Efficiency

The Truck Telematics Market is experiencing a notable surge in demand for enhanced fleet efficiency. Companies are increasingly recognizing the value of telematics solutions in optimizing routes, reducing fuel consumption, and improving overall operational efficiency. According to recent data, the implementation of telematics can lead to a reduction in fuel costs by up to 15%. This growing emphasis on efficiency is driving investments in telematics systems, as businesses seek to maximize their return on investment. Furthermore, the ability to monitor vehicle performance in real-time allows fleet managers to make informed decisions, thereby enhancing productivity and reducing downtime. As a result, the Truck Telematics Market is poised for significant growth, with more organizations adopting these technologies to streamline their operations.

Regulatory Compliance and Safety Standards

The Truck Telematics Market is significantly influenced by the increasing regulatory compliance requirements and safety standards imposed on the transportation sector. Governments are implementing stringent regulations aimed at improving road safety and reducing emissions. For instance, the introduction of electronic logging devices (ELDs) mandates that commercial vehicles track their driving hours, which has propelled the adoption of telematics solutions. This regulatory landscape not only ensures compliance but also enhances safety by providing real-time data on driver behavior and vehicle conditions. The market is projected to grow as companies invest in telematics systems to meet these regulations while simultaneously improving their safety records. Consequently, the Truck Telematics Market is likely to see a rise in demand for solutions that facilitate compliance and promote safer driving practices.

Technological Advancements in Connectivity

The Truck Telematics Market is being propelled by rapid technological advancements in connectivity solutions. The advent of 5G technology is set to revolutionize telematics by enabling faster data transmission and more reliable communication between vehicles and central systems. This enhanced connectivity allows for real-time monitoring and analytics, which are crucial for fleet management. Moreover, the integration of Internet of Things (IoT) devices is facilitating the collection of vast amounts of data, which can be analyzed to improve operational efficiency. As businesses increasingly seek to leverage these technologies, the Truck Telematics Market is expected to expand significantly. The ability to harness data for predictive maintenance and performance optimization is becoming a key differentiator for companies in the transportation sector.