Research Methodology on Telematics Market

Introduction

This research methodology is designed to provide an in-depth analysis of the global Telematics market. The concept of telematics encompasses both hardware and software technologies that facilitate data transmission and communication between the hardware and the consumer. This market has a wide range of products and technologies that include usage-based insurance, navigation systems, fuel monitoring, infotainment, and vehicle security systems.

Research Objective

The primary objective of this research is to gain an in-depth understanding of the global Telematics market, including market analysis, trends, and growth opportunities. The secondary objectives of this research are to identify the key market players and to evaluate the strategies they have adopted to gain a competitive advantage.

Research Design

The research methodology adopted for this research follows a deductive approach, wherein data and information gathered from primary and secondary sources are analyzed to gain insights into the global Telematics market. To gain an in-depth understanding of the Telematics market, both, qualitative and quantitative methods have been used.

Research Process

The research process for this research report consists of the following sections:

- Data Collection: This section involves the collection of data from primary and secondary sources. Primary data is collected from industry experts through interviews and surveys. Secondary data is collected from journals, industry reports, books, company websites, and industry databases.

- Market Segmentation: The market is segmented on the basis of product type, application, and region.

- Market Estimation: The data collected from primary and secondary sources are used to estimate the current and future market. This is done by using elaborate market estimation models.

- Data Validation: Once the market size and estimates have been determined, they have been further validated through significant primary research.

- Data Analysis and Interpretation: The market data and estimates are analyzed and interpreted using statistical methods.

- Market Forecast: Based on the data collected, the market is forecasted for the forecast period 2023 to 2030.

- Final Report: The final report is prepared based on the data collected and analysis done during the research process.

Research Sources

The primary sources of data and information for this research report include industry experts, company executives, and market players. The secondary sources of data and information include industry journals, books, company websites, and industry reports.

Pricing Analysis

The pricing analysis for the Telematics market is carried out through primary research conducted with industry players. The pricing analysis provides insights into the pricing strategies adopted by the market players to gain a competitive advantage.

Geographical Analysis

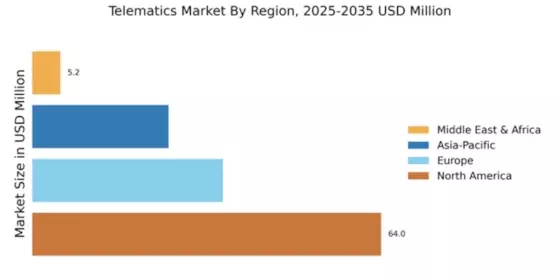

The geographical analysis of the global Telematics market is conducted by studying the market size and growth opportunities in the United States, Europe, Asia-Pacific, Middle East & Africa, and Latin America.