Truck Axle Market Summary

As per Market Research Future analysis, the Truck Axle Market Size was estimated at 1689.04 USD Million in 2024. The Truck Axle industry is projected to grow from 1769.78 USD Million in 2025 to 2822.95 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.78% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Truck Axle Market is poised for growth driven by sustainability and technological advancements.

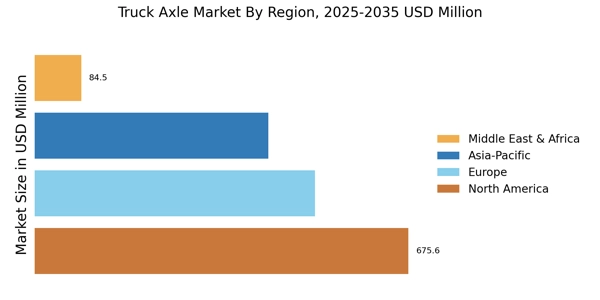

- North America remains the largest market for truck axles, driven by robust demand for commercial vehicles.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization and urbanization.

- Rigid axles dominate the market, while drive steer axles are witnessing the fastest growth due to evolving vehicle designs.

- Key market drivers include increasing demand for commercial vehicles and a rising focus on fuel efficiency and sustainability.

Market Size & Forecast

| 2024 Market Size | 1689.04 (USD Million) |

| 2035 Market Size | 2822.95 (USD Million) |

| CAGR (2025 - 2035) | 4.78% |

Major Players

Meritor Inc (US), Dana Incorporated (US), ZF Friedrichshafen AG (DE), Bendix Commercial Vehicle Systems LLC (US), Schaeffler AG (DE), Eaton Corporation (US), Wabco Holdings Inc (US), AxleTech International LLC (US)