Increasing Vehicle Production Rates

The rising production rates of vehicles across various segments are a crucial driver for the Automotive Axle Market. As automotive manufacturers ramp up production to meet consumer demand, the need for axles is expected to surge. In 2025, vehicle production is projected to reach unprecedented levels, particularly in emerging markets where automotive ownership is on the rise. This increase in production not only boosts the demand for axles but also encourages manufacturers to optimize their supply chains and production processes. Consequently, the Automotive Axle Market is likely to experience robust growth as a result of these production trends.

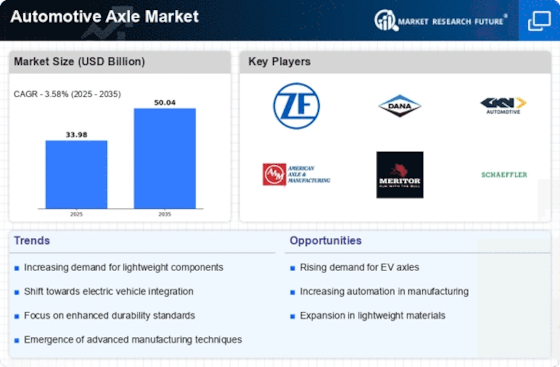

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is a pivotal driver for the Automotive Axle Market. As consumers become more environmentally conscious, the shift towards EVs necessitates the development of specialized axles that can support electric drivetrains. In 2025, it is estimated that the market for electric vehicles will account for a substantial portion of total vehicle sales, leading to a corresponding rise in demand for lightweight and efficient axles. This trend is likely to encourage manufacturers to innovate and adapt their axle designs to meet the unique requirements of electric vehicles, thereby propelling growth in the Automotive Axle Market.

Expansion of the Aftermarket Segment

The expansion of the aftermarket segment is emerging as a significant driver for the Automotive Axle Market. As vehicle ownership increases, the demand for replacement and upgraded axles is also on the rise. Consumers are increasingly seeking high-performance and durable axles to enhance their vehicles' capabilities. In 2025, the aftermarket for automotive components, including axles, is projected to grow substantially, driven by trends such as vehicle customization and maintenance. This growth presents opportunities for manufacturers to diversify their product offerings and cater to the evolving needs of consumers, thereby fueling the Automotive Axle Market.

Technological Advancements in Axle Design

Technological advancements are significantly influencing the Automotive Axle Market. Innovations such as the integration of lightweight materials and advanced manufacturing techniques are enhancing axle performance and efficiency. For instance, the use of carbon fiber and aluminum alloys is becoming more prevalent, allowing for the production of axles that are not only lighter but also stronger. This shift is expected to improve fuel efficiency and vehicle handling, which are critical factors for consumers. As manufacturers continue to invest in research and development, the Automotive Axle Market is poised for substantial growth driven by these technological enhancements.

Focus on Fuel Efficiency and Emissions Reduction

The growing emphasis on fuel efficiency and emissions reduction is shaping the Automotive Axle Market. Regulatory bodies are implementing stricter emissions standards, compelling manufacturers to develop vehicles that are more fuel-efficient. This trend necessitates the design of axles that contribute to overall vehicle efficiency. In 2025, it is anticipated that vehicles equipped with advanced axle systems will be favored in the market, as they offer improved performance and lower emissions. As a result, the Automotive Axle Market is expected to expand as manufacturers respond to these regulatory pressures and consumer preferences for greener vehicles.