Rising Healthcare Expenditure

Rising healthcare expenditure is another pivotal driver of the Trauma Fixation Devices Market. As countries allocate more resources to healthcare, there is a corresponding increase in investments in advanced medical technologies, including trauma fixation devices. This trend is particularly pronounced in regions where healthcare reforms are underway, leading to improved access to quality care. Increased funding allows healthcare facilities to upgrade their equipment and adopt innovative fixation solutions, thereby enhancing patient care. Furthermore, the growing emphasis on evidence-based practices is likely to drive the adoption of advanced trauma fixation devices, as providers seek to implement the most effective treatment options. This trend suggests a promising outlook for the Trauma Fixation Devices Market, as financial resources become more readily available for technological advancements.

Focus on Rehabilitation and Recovery

The focus on rehabilitation and recovery is increasingly influencing the Trauma Fixation Devices Market. As healthcare providers recognize the importance of comprehensive care, there is a growing emphasis on devices that facilitate not only stabilization but also effective rehabilitation. This shift is prompting manufacturers to develop fixation devices that are compatible with rehabilitation protocols, ensuring a seamless transition from surgery to recovery. Data indicates that patients who receive integrated care experience better outcomes, which is likely to drive demand for innovative fixation solutions. Additionally, the rise of multidisciplinary approaches in trauma care is fostering collaboration among healthcare professionals, further enhancing the effectiveness of treatment. This trend underscores the potential for growth within the Trauma Fixation Devices Market, as the focus on holistic patient care continues to gain traction.

Increasing Incidence of Trauma Cases

The rising incidence of trauma cases, including road accidents, falls, and sports injuries, is a primary driver for the Trauma Fixation Devices Market. According to recent data, trauma cases have surged, leading to a heightened demand for effective fixation devices. This trend is particularly evident in regions with high population density and active lifestyles. As the number of trauma cases escalates, healthcare providers are increasingly investing in advanced fixation technologies to ensure optimal patient outcomes. The need for timely and effective treatment solutions is paramount, thereby propelling the growth of the Trauma Fixation Devices Market. Furthermore, the increasing awareness of trauma care and rehabilitation is likely to contribute to the sustained demand for these devices, as patients seek better recovery options.

Aging Population and Orthopedic Injuries

The aging population is a significant driver of the Trauma Fixation Devices Market. As individuals age, they become more susceptible to orthopedic injuries, such as fractures and joint dislocations. This demographic shift is leading to an increased demand for trauma fixation devices that cater specifically to the needs of older patients. Data indicates that the elderly population is projected to grow substantially, resulting in a higher incidence of trauma-related injuries. Consequently, healthcare systems are focusing on developing specialized fixation devices that address the unique challenges faced by this demographic. The emphasis on improving the quality of life for elderly patients is likely to further stimulate the Trauma Fixation Devices Market, as providers seek to offer tailored solutions for effective recovery.

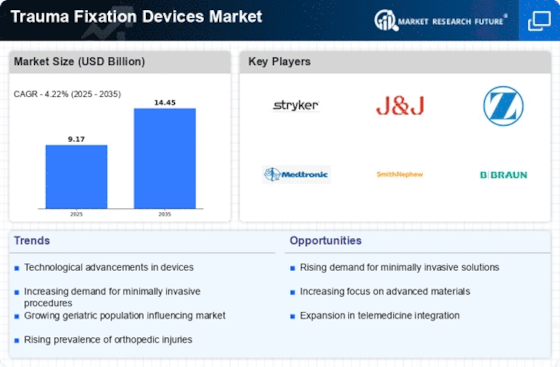

Technological Innovations in Fixation Devices

Technological innovations play a crucial role in shaping the Trauma Fixation Devices Market. The introduction of advanced materials, such as bioresorbable polymers and lightweight metals, has enhanced the performance and safety of fixation devices. These innovations not only improve patient comfort but also reduce the risk of complications associated with traditional fixation methods. Additionally, the integration of smart technologies, such as sensors and monitoring systems, is emerging as a trend within the industry. These advancements enable real-time tracking of healing progress, which is likely to enhance patient outcomes. As healthcare providers increasingly adopt these cutting-edge technologies, the Trauma Fixation Devices Market is expected to experience significant growth, driven by the demand for more effective and efficient treatment solutions.