North America : Market Leader in Innovation

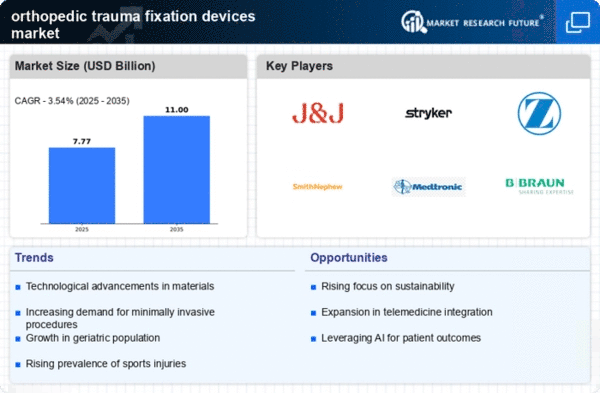

North America is poised to maintain its leadership in the orthopedic trauma fixation devices market, holding a significant market share of 3.75 billion in 2025. Key growth drivers include an aging population, increasing incidence of orthopedic injuries, and advancements in surgical techniques. Regulatory support from agencies like the FDA further catalyzes innovation and market expansion, ensuring that new technologies are rapidly adopted to meet healthcare demands. The competitive landscape is dominated by major players such as DePuy Synthes, Stryker, and Zimmer Biomet, which are continuously innovating to enhance product offerings. The U.S. remains the largest market, driven by high healthcare expenditure and a robust infrastructure for medical devices. The presence of leading companies fosters a dynamic environment for research and development, ensuring that North America remains at the forefront of orthopedic solutions.

Europe : Emerging Market with Growth Potential

Europe's orthopedic trauma fixation devices market is valued at 2.25 billion in 2025, driven by increasing healthcare investments and a growing elderly population. The region benefits from stringent regulatory frameworks that ensure high-quality standards for medical devices. Countries like Germany and the UK are leading the market, supported by advanced healthcare systems and rising demand for minimally invasive surgeries, which are expected to boost market growth significantly. The competitive landscape features key players such as B. Braun and Smith & Nephew, who are focusing on innovation and strategic partnerships to enhance their market presence. The European market is characterized by a mix of established companies and emerging startups, fostering a competitive environment that encourages technological advancements. As the region continues to invest in healthcare infrastructure, the orthopedic trauma fixation devices market is set for substantial growth.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 1.5 billion in 2025, is witnessing rapid growth in the orthopedic trauma fixation devices sector. Factors such as rising disposable incomes, increasing awareness of advanced medical technologies, and a growing elderly population are driving demand. Additionally, government initiatives aimed at improving healthcare access and quality are expected to further stimulate market growth in this region. Leading countries like China and India are emerging as key players in the orthopedic market, with significant investments in healthcare infrastructure. The competitive landscape includes both multinational corporations and local manufacturers, creating a diverse market environment. Companies are focusing on product innovation and affordability to cater to the unique needs of the region, ensuring that the Asia-Pacific market remains dynamic and competitive.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently represents an untapped market for orthopedic trauma fixation devices, with a market size of 0.0 billion in 2025. Despite the low market size, there is significant potential for growth driven by increasing healthcare investments and a rising prevalence of orthopedic injuries. Governments are focusing on improving healthcare infrastructure, which is expected to create opportunities for market expansion in the coming years. Countries like South Africa and the UAE are beginning to invest in advanced medical technologies, although the market remains fragmented. The presence of local manufacturers and international players is gradually increasing, fostering competition. As healthcare systems evolve and patient awareness grows, the orthopedic trauma fixation devices market in the Middle East and Africa is likely to see gradual but steady growth.