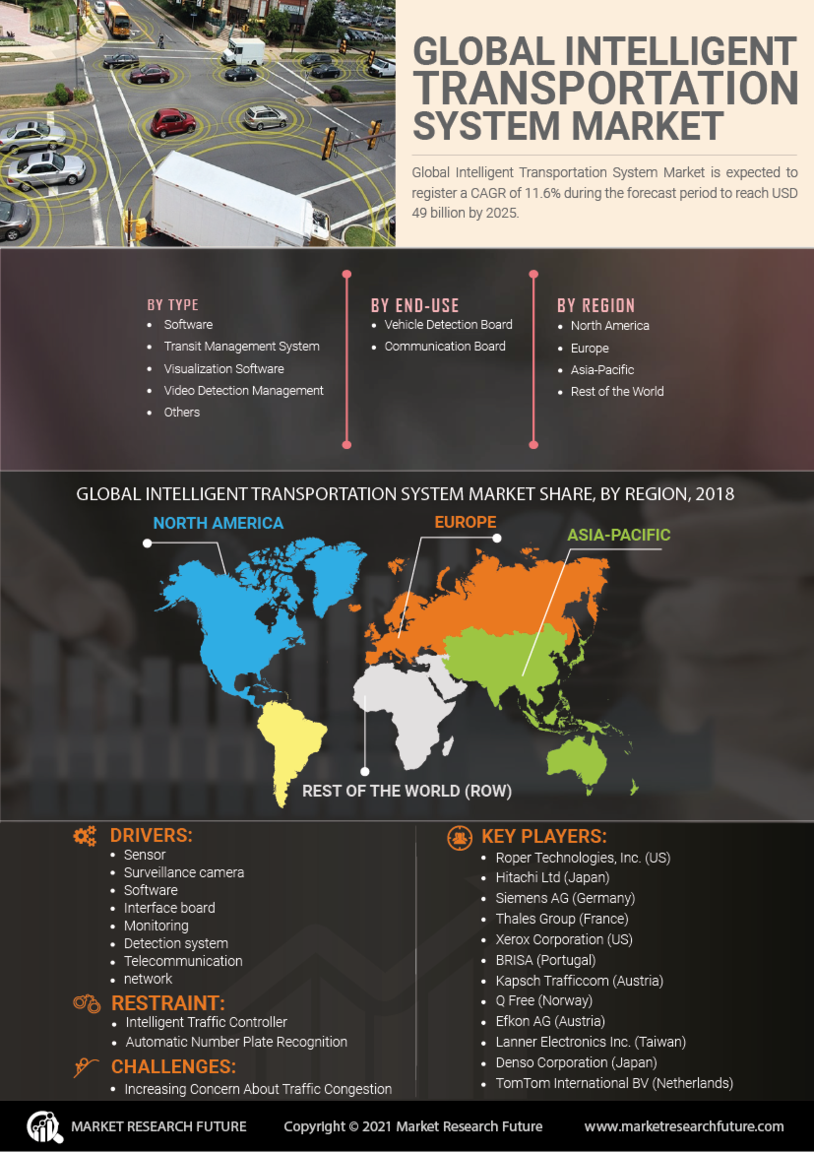

Rising Urbanization

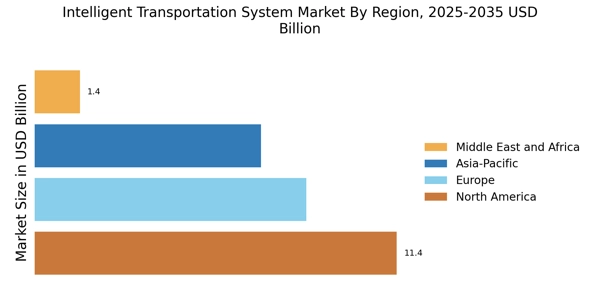

The rapid pace of urbanization is a key driver for the Intelligent Transportation System Market. As more individuals migrate to urban areas, the demand for efficient transportation solutions intensifies. Urban centers are experiencing increased traffic congestion, which necessitates the implementation of intelligent transportation systems to optimize traffic flow and enhance safety. According to recent data, urban areas are projected to house approximately 68% of the world's population by 2050, further stressing existing transportation infrastructures. This trend compels city planners and governments to invest in advanced technologies that can alleviate congestion and improve public transport efficiency. Consequently, the Intelligent Transportation System Market is likely to witness substantial growth as municipalities seek to modernize their transport networks to accommodate burgeoning populations.

Increased Focus on Safety

The heightened focus on safety is a significant driver for the Intelligent Transportation System Market. With rising concerns over road safety and accident rates, there is a pressing need for systems that can enhance the safety of transportation networks. Intelligent transportation systems offer solutions such as advanced driver assistance systems, automated traffic enforcement, and real-time incident detection, which contribute to reducing accidents and improving overall road safety. Data indicates that implementing intelligent transportation solutions can lead to a reduction in traffic fatalities by up to 30% in some regions. This emphasis on safety is prompting governments and private entities to invest in intelligent transportation technologies, thereby fostering growth within the Intelligent Transportation System Market. As safety remains a priority, the demand for innovative solutions is expected to escalate.

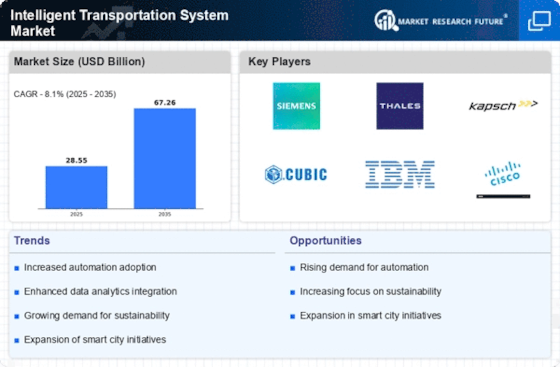

Technological Advancements

Technological advancements are fundamentally transforming the Intelligent Transportation System Market. Innovations in areas such as artificial intelligence, machine learning, and the Internet of Things are enabling the development of sophisticated transportation solutions. These technologies facilitate real-time data collection and analysis, which enhances decision-making processes for traffic management and public transportation systems. For example, the integration of AI algorithms in traffic signal control systems has been shown to reduce wait times and improve traffic flow efficiency. Furthermore, the proliferation of connected vehicles is anticipated to create new opportunities for the Intelligent Transportation System Market, as these vehicles can communicate with infrastructure and other vehicles to optimize travel routes. The continuous evolution of technology is likely to drive the market forward, as stakeholders seek to leverage these advancements to create smarter, safer transportation networks.

Environmental Sustainability

Environmental sustainability is increasingly influencing the Intelligent Transportation System Market. As concerns over climate change and pollution intensify, there is a growing demand for transportation solutions that minimize environmental impact. Intelligent transportation systems can significantly contribute to sustainability efforts by optimizing traffic flow, reducing emissions, and promoting the use of public transportation. For instance, studies suggest that implementing smart traffic management systems can lead to a reduction in greenhouse gas emissions by up to 20%. Additionally, the integration of electric and hybrid vehicles within intelligent transportation frameworks further supports sustainability goals. As stakeholders prioritize eco-friendly practices, the Intelligent Transportation System Market is likely to experience growth driven by the need for sustainable transportation solutions that align with global environmental objectives.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in propelling the Intelligent Transportation System Market. Various governments are increasingly recognizing the importance of intelligent transportation systems in enhancing road safety, reducing traffic congestion, and minimizing environmental impact. For instance, numerous countries have allocated significant budgets to develop smart transportation infrastructure, with investments reaching billions of dollars annually. These initiatives often include grants, subsidies, and public-private partnerships aimed at fostering innovation in transportation technologies. The commitment to improving transportation systems is evident in policies that promote the adoption of smart traffic management solutions and connected vehicle technologies. As a result, the Intelligent Transportation System Market is expected to benefit from sustained government support, which is likely to drive advancements and adoption rates in the sector.