Top Industry Leaders in the Transportation Management Systems Market

Competitive Landscape of Transportation Management System Market

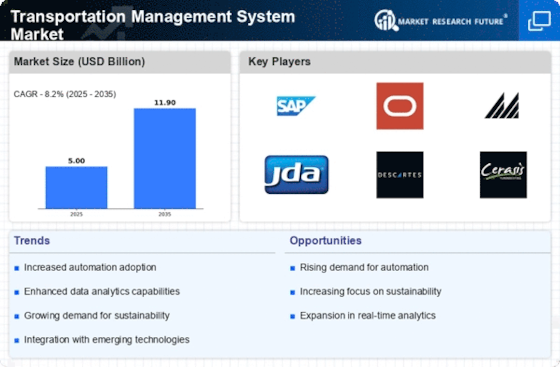

The global transportation management system (TMS) market is experiencing rapid growth, propelled by factors such as heightened demand for streamlined logistics and supply chain management, the surge in e-commerce, and increased adoption of cloud-based solutions.

Key Players:

- Oracle Corporation (US)

- JDA Software Group Inc. (US)

- Manhattan Associates Inc. (US)

- Descartes Systems Group Inc. (Canada)

- SAP SE (Germany)

- BluJay Solutions Ltd (US)

- CTSI-GLOBAL (US)

- EFKON GmbH (Austria)

- Alpega Group (Austria)

- HighJump (US)

- MercuryGate (US)

Strategies Adopted:

The TMS market's competitive landscape is marked by fierce competition, with participants employing diverse strategies to enhance their market share. Key strategies encompass:

- Ongoing Product Innovation: Continual development and innovation of TMS solutions to meet evolving customer needs.

- Industry-Specific Focus: Targeting particular sectors, such as retail and e-commerce, with a need for advanced logistics solutions.

- Mergers and Acquisitions: Strategic mergers and acquisitions to broaden product portfolios and geographical reach.

- Partnerships and Collaborations: Establishing partnerships with technology firms, carriers, and logistics providers to provide comprehensive solutions.

- Cloud-Based Solutions: Heightened emphasis on creating and offering cloud-based TMS solutions in response to the growing trend of cloud adoption.

- User Experience Focus: Investment in user experience design to create intuitive and user-friendly TMS solutions.

Factors for Market Share Analysis:

Several factors are considered when evaluating market share within the TMS industry, including:

- Market Size: The overall size of the TMS market, measured in revenue or user base.

- Product Portfolio: The range and depth of TMS solutions provided by each player.

- Geographic Reach: The geographic presence of each player, encompassing their involvement in key markets and regions.

- Customer Base: The types of customers served by each player, such as small and medium-sized businesses (SMBs) or large enterprises.

- Technology Stack: The technology stack employed by each player to develop and deliver their TMS solutions.

- Financial Performance: The financial performance of each player, encompassing revenue, profitability, and market capitalization.

New and Emerging Companies:

The TMS market is also witnessing the emergence of novel and innovative companies, often concentrating on niche market segments or offering next-generation solutions utilizing technologies like artificial intelligence (AI) and machine learning (ML). Examples of such companies include:

- FourKites (specializing in supply chain visibility)

- Project44 (specializing in supply chain visibility)

- BluJay Solutions (offering cloud-based TMS)

- Ryder System (providing transportation and logistics services)

- Arrive Logistics (specializing in trucking and logistics)

Latest Company Updates:Jan 2023 - Oracle Corporation joined hands with Red Hat Enterprise to bring in the Red Hat Open Shift to Oracle's Cloud Infrastructure.

The strategic collaboration between these two tech giants for OCI bare metal and Oracle VMware Cloud workloads will enable certified and supported configurations or Red Hat Openshift to run on OCI.

May 2023 - Descartes System became a service partner for Etihad Cargo to enhance its shipment services visibility using IoT - the Internet of Things and data-driven real-time insights.

September 2023 - Mercury Gate delivered its first to final mile transportation management solutions that leverage Amazon Web Services as a preferred cloud provider, making it a big achievement for the company.

Recent Development:Real-Time Visibility:

Real-Time Visibility is one of the latest key innovations in transportation management systems which is an enhancement of the real-time visibility across the supply-chain system.

Real-time visibility refers to track and monitoring the status, location and real-time condition of the shipments and assets that are in transit.

Dynamic Routing:

Dynamic Routing is a new technique in the transportation management system, which is a process of adjusting and optimizing the routes as well as the transportation schedules on a real-time basis.

Dynamic routing technology helps transportation companies to reduce their costs, and emissions and increase efficiency.